Definition of Balance Sheet

1. Balance Sheet is a list of debit and credit balances taken from ledger accounts and Cash Book on a particular date. Balance Sheet is not an account.

2. Balance Sheet can be safely provided, just hope to test the accuracy of double account records in the ledger and Cash Book.

3. Guides provide Balance Sheet :

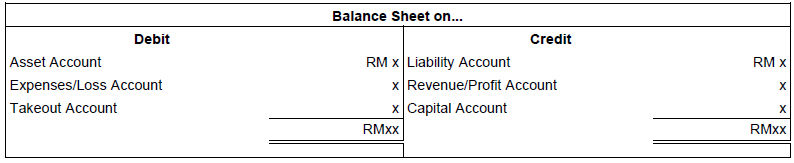

(a) All outstanding balance of the debit and Cash Book are recorded on debit side of the Balance Sheet. For example, asset accounts (such as premises, vehicles, office equipment, debtors, cash, bank), expense and loss accounts (such as insurance, general expenses, purchases, bad debts, loss on asset sales) and uptake accounts.

(b) All credit balances in the ledger and Cash Book are recorded on credit side of Balance Sheet. For example, owners’ equity accounts (such as modal accounts), liability accounts (such as loans, mortgages, creditors), revenue accounts and profits (such as commission received, rental received, sales, profit on asset sales).

4. In conclusion, debit and credit balances in the Balance Sheet are listed as follows:

Objective Of Balance Sheet Preparation

1. Check the accuracy of the following aspects:

(a) calculations in Books of Original Entry to Ledger.

(b) posting from the Books of Original Entry to the Ledger.

(c) record transactions based on double-entry systems.

2. Easy to prepare the Income Statement and Balance Sheet.

Limitations Of Balance Sheet Used

1. Balance sheet does not mean that all entries are accurate and correct.

2. There are several types of mistakes that do not affect the balance of Balance Sheet.

3. A balanced Balance Sheet may have the following errors:

(a) Error omitting a transaction.

Direct transactions are not recorded in any book

Example:

Takeout of RM150 worth of items for personal use forgot to be recorded.

Balance Sheet is still balanced even though no entry is made in the Takeout Account and Purchase Order. In this case, the amount of each debit and credit for Balance Sheet recorded is less than RM150.

(b) Principle Error

Details recorded in the wrong type of accounts (modal expenses is recorded as revenue expenses and so on)

Example:

The cost of repairing the roof of the premises is RM460 in discharge into premises account.

Balance Sheet is still balanced because the amount of Debit was not affected.

(c) Commissions Error

Details recorded in wrong individual account

Example:

Purchase from Jasni is worth RM180 and has been credited into Jasni’s account

Trial Balance is still balanced because the amount of credit was not affected.

(d) Original Record Error

The error of amount from the First Entry Book is posted to the ledger.

Example:

Purchase from Mohandas Company RM306 is written as RM360 in the Purchase Journal. During posting to Ledger, the amount of RM360 is debited in the Purchase Account and credited to Mohandas Company.

In this case, the amount of each credit and debit for Trial Balance recorded is more as much as RM54. The Balance Sheet is still balanced.

(e) Offense Error

The debit error of an account is offset by the same mistake of amount for other account credits and so on.

Example:

The purchase is below RM250, as well as an understated sales of RM250.

Amount of each debit and credit for Balance Sheet recorded is understated as much as RM250. The Balance Sheet is still balanced.

(f) Inverse Error

Transactions are recorded in the correct account but on the wrong side. The account that should have been debited has been credited and so on.

Example:

Check received worth RM1200 from Kok Leong have been incorrectly debited in Kok Leong’s account and credited to Bank Account.

In this case, only doubled-entry reversed. Debit and credit amount are not affected. The Balance Sheet is still balanced.

4. The imbalanced Balance Sheet may also have the following mistakes:

(a) Incomplete double-entry

Forget to record the debit or credit for a transaction.

Example:

Buy furniture on credit from Firdaus Company RM850 is only recorded in the Furniture Account only.

In this case, the amount of credit for Trial Balance recorded is understated as much as RM850.

(b) Amount Error

The amount of the debit is different than the amount of the credit for a transaction.

Example:

Purchase an item from Theresa Company worth RM980 was recorded correctly into Purchase Journal but has been posted to Theresa Company Account by Purchase Ledger as much as RM890.

In this case, the amount of credit for Trial Balance recorded is understated as much as RM90.

(b) A similar transaction is recorded twice

A transaction was recorded twice for debit or credit.

Example:

Credit sales of RM960 to Virmala have been credited into sales account and Vimala Account.

In this case, the amount of credit for Balance Sheet recorded is more as much as RM960 meanwhile the amount of debit for Balance Sheet recorded is understated as much as RM960. Difference of the Balance Sheet is RM1920.

(d) Error in Balance Sheet

i. Error in calculating the amount of debit or credit

ii. The error listing the balances for the Balance Sheet. The debit balance has been listed into credit and so on.

Example:

i. Withdrawal of RM80 is wrongly listed into credit for Balance Sheet.

ii. The RM880 bank overdraft is incorrectly listed into debit for Balance Sheet.

For,

i. The difference of Balance Sheet is RM160 (Debit recorded is understated as much as RM80 and credit recorded is more as much as RM80).

ii. Debit for the Balance Sheet recorded is more as much as RM880 meanwhile credit for the Balance Sheet recorded is understated as much as RM880. This causes the difference for Balance Sheet is RM1760.

The Ways To Detect Error

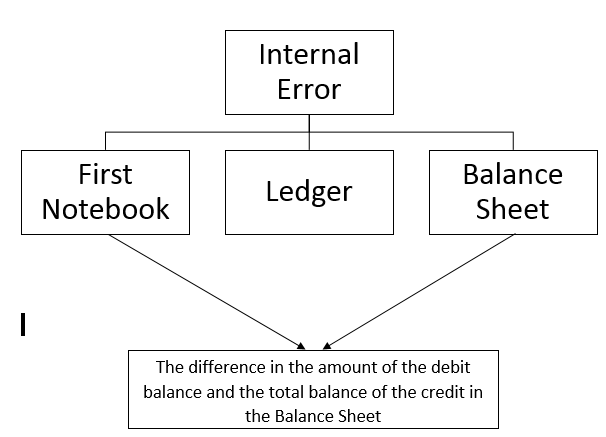

1. The difference in the amount of the debit balance and the amount of credit balance for the Balance Sheet may be due to an error or more error.

2. The error may be comes from the Balance Sheet itself the ledger or the Books of Original Entry.

3. The following guide can be used to detect errors.

(a) Check the total debit amount and total credit on Balance Sheet.

(b) Find difference between total debit and credit. For example, the difference is RM80. Find an account that have balance RM80 with ledger. Maybe there is a certain balance with Ledger that was not listed in the

(c) Divide the total difference into two, such as RM40 and find out whether there is an account that has the same amount in the Balance Sheet. If available, make sure the detail placed in the right place because of this mistake may be caused by the balance placed in the wrong place (debit placed into credit and so on).

(d) Check again to make sure all of the balance from Ledger Account has been listed in Balance Sheet.Make sure that the debit balance by Ledger was placed inside the debit for Balance Sheet with a correct amount. Similar to all credit balance by Ledger was placed inside the credit for Balance Sheet with a correct amount.

(e) Check the Ledger Account and make sure that:

i. Calculation for all ledger account is correct.

ii. The amount inside the Books of Original Entry posted to the correct account and correct Ledger Account.

iii. All items were posted to certain accounts by ledger. Do not forget the discount space for cash book debit posted to Discount Given Account and discount space for cash book credit posted to Discount Received Account.