The financial statements of a business are made available to determine the profit or loss of a business and the financial position of the business at the end of an accounting period.

The financial statements comprise:

(a) Income Statement

(b) Balance

Author: Franco

Accounting Cycle

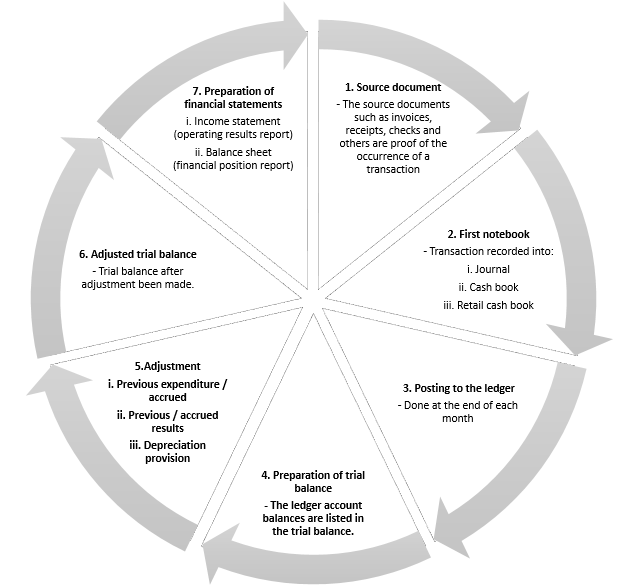

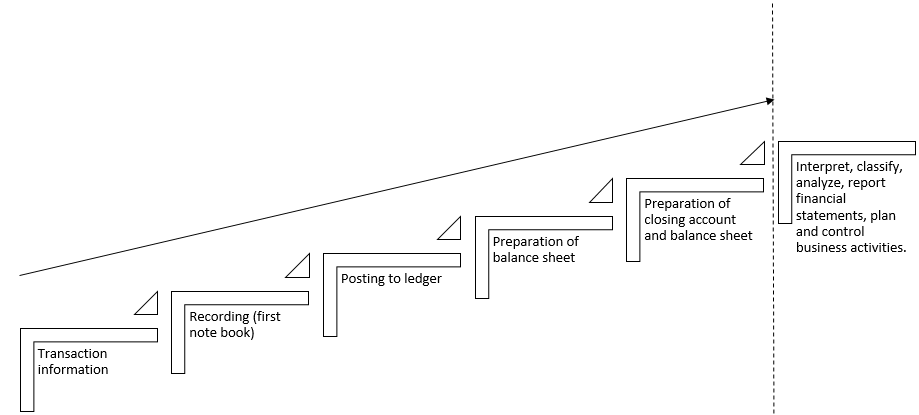

1. Accounting cycle is a complete accounting process beginning with the occurrence of a transaction to the financial level.

2. The accounting cycle can be illustrated through the flow chart below.

3. Stages in this cycle are performed in a systematic order.

One cycle takes about one accounting period to be completed and restated in subsequent accounting periods.

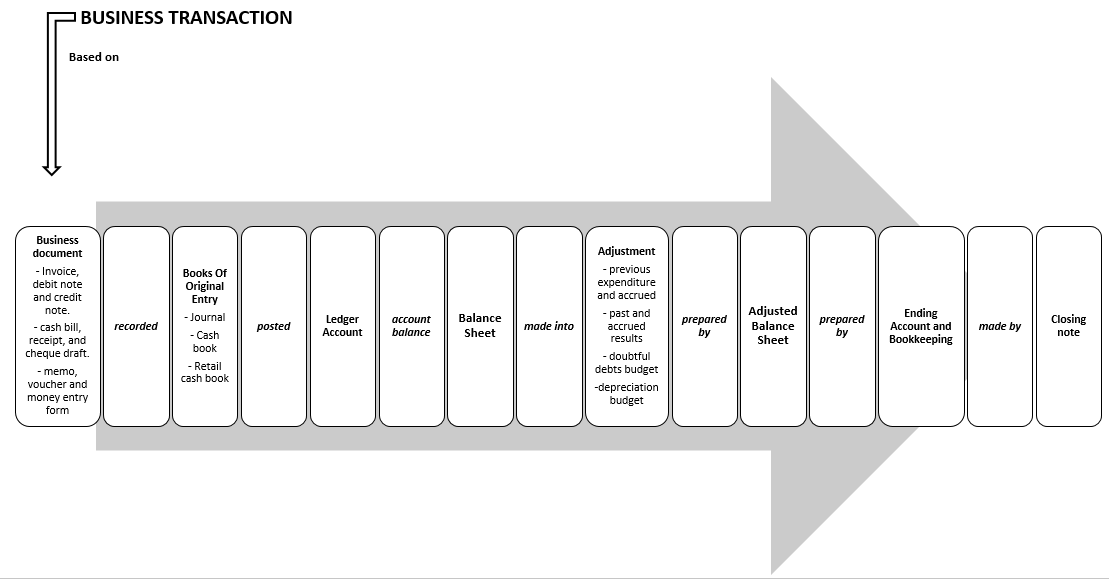

4. The following table summarizes the accounting cycle.

| Accounting Cycle Stage | Document/Transaction Record | Recording Frequency |

| The source document as proof of the occurrence of a transaction | Source documents (invoices, checks, credit notes, debit notes, etc.) | Daily |

| Record transactions | Books of Original Entry | Daily |

| Post to ledger | Ledger | End of month |

| Preparation of balance sheet | Worksheet | End of month or end of the accounting period |

| Doing adjustment | ||

| Preparation of Ending Account and Balance Sheet | ||

| Preparation of Ending Account and Balance Sheet | Worksheet/financial statements | End of accounting period |

| Closing notes | General journal | End of the accounting period |

Timeline of Accounting History

3500 B.C.

– Earliest recorded at Babylonia.

– Clay sheets are used to keep records.

400 B.C.

– The discovery of papyrus(paper) and calamus(pen) in Egypt.

5th & 6th Century B.C.

– Money is used as an intermediary exchange.

850 A.D.

– The Hindu-Arab numeral system was introduced by

14th Century

– Double entry system started in Venice, Italy.

– The year 1494 – Luca Pacioli published “summa” book which contains a part which related to double entry.

– Luca Pacioli designed a basics of accounting which in practice nowadays.

He is known as the father of accounting.

– Bookkeeping that based on double entry is also known as the Venetian Method.

18th & 19th Century

– The industrial revolution in England.

– Mass production – Cost accounting exists.

– Formation of a company – need to present financial reports – Financial Accounting exists.

– Accounting information is used by management to plan and manage the business more efficiently – Management Accounting exists.

20th Century

– Accounting field reaches a professional level.

– Accounting professional bodies are established.

– Accountants are subject to licensing rules, accounting code ethics rules of the accounting profession, and high academic qualification requirements.

– 1969 – Accounting Standards Committee established in England and Wales – issue a Standard Accounting Practice Statement to standardize accounting practices.

– 1973 – The International Standards Committee (I.A.S.C) was established in Sydney to enact International Accounting Standards (I.A.S) so that accounting practices are shared internationally.

Basic Accounting Concepts and Principles

1. Separate Entity

– separate businesses with their owners

– business dealings with its owners are regarded as an affair between two separate parties. Capital Account and Takeout Account are opened to record the affairs.

2. Money as Measurement

the transaction must be recorded in the form of money.

Limitations of this concept:

(a) Aspects that cannot be measured with money cannot be recorded.

(b) The value of the currency changes from time to time

3. Historical cost

– transactions are recorded based on the purchase cost at the date of purchase although the present value has changed.

– this concept is used to record assets in the Balance Sheet.

– The concept is held so that financial records are more objective.

4. Body persist

– businesses are assumed to have a continuous life and are not dissolved in the short term.

– Business assets will continue to be used to generate income for the business.

5. Matching concept / Accrual concept

– the amount of revenue in a certain amount must be matched with expenses during the same period for profit or loss during the period.

– all past and past accruals and expenses will be taken into account when seeking profits or business losses

6. Double entry principle

– each transaction is recorded in two separate accounts on the opposite side of the same amount.

– according to the principle of double entry, when a transaction is recorded, the total amount of debit entries must equal the total amount of the credit record of the transaction.

Basic Accounting Concepts and Principles

1. All reports and financial statements presented must be based on accepted principles and standards of public acceptance and recognition.

2. The accounting principle is based on the following concepts.

Separate Entity

1. Business is a separate entity or entity from the business owner.

2. This concept is complied with by all forms of

3. Any dealings between a business and its owner are regarded as an affair between two separate parties.

4. Only business-related transactions are recorded in the business book. For example, the owner bought a living room furniture with his personal money.

5. The capital invested by the owner into his business is considered as the owner’s loan to his business. Therefore, the owner is considered a creditor to the business.

Money As Measurement

1.

2. Each transaction must be recorded in the form of money.

3. Money is a unit of measurement and intermediate exchange in all business transactions.

4. The limitation of this concept is that only the factors that can be measured with money can only be recorded. Objectives that

History Cost

1. The historical cost concept means an asset purchase transaction is recorded based on the cost of the purchase at the date of purchase although the market value or the present value of the asset has changed.

2. This concept is used to record the value of the assets shown in the Balance Sheet.

3. For example, a vehicle bought for RM32,000. A year later, the value of the vehicle dropped to RM29,000. Under the historical cost concept, the business will still show the vehicle at RM32,000 in its record, which is the cost (vehicle purchase price) of the vehicle.

4. This concept is also applied when recording the owner’s liability and equity value. The purpose of this concept is to make records and financial reports more objective.

Persistent Body

1. An assumed business will continue to operate for a prolonged period and its assets will continue to be used to generate income for the business.

2. Businesses do not have to report assets at their liquidation value because businesses are not expected to be dissolved in the short term

3. Business is considered to have a continuous life.

Accounting Period

1. The life of a business is ongoing. It is therefore necessary to divide the life of the business into the same and constant accounting period. For example a year, a half year, a quarter, and so on.

2. In this way, the outcome of a business operation may be known at the end of each accounting period. In addition, comparisons can be made between two accounting periods to evaluate their business performance.

3. The accounting period of a business depends on the size and nature of the business.

4. The diagram below shows the life of a business that is divided into a fixed accounting period.

5. To seek profit or loss for a period, only transactions affecting the profit or loss of the business for that period are taken into account.

Matching Concepts

1. This concept states that to calculate net profits from the accounting period, the amount of revenue within that period must be matched with expenses over the same period.

2. Expenses are the cost of handling a business eg purchases of merchandise, payroll, rental, insurance, etc.

3. Business revenue comprises proceeds from sales of merchandise or services, rental receipts, commissions, discounts, and so on.

4. This concept is also known as an accrual concept.

Double entry system

1. The double entry system is a system of recording each transaction in two separate accounts on the opposite side, an account is debited while another account is credited with the same amount, namely:

a. When one party enters, there must be

b. When an amount is given, there must be an equal amount of money received.

Thus, the principle of

a.

b. Credit amount that gives something amount.

The amount of debit records is always the same as the total credit record at all times.

2. Accounting equation can always be maintained if the

3. This system can determine the accuracy of the recording process by providing a Balance Sheet from time to time.

Accounting Method

There are three methods for processing accounting data. Although the methods are different, the basis is the same, that is, transactions are recorded on a double-entry system. The difference is only in terms of data collection, data storage, and data speeds being processed.

Manual Method

1. This method is not assisted by mechanical devices.

2. All accounting operations are done by hand or manual.

3. This method is suitable for small businesses such as hawkers.

4. The disadvantages of this method are slow, Many time and energy are used to make routine work such as recording and counting. The frequency of recording and counting errors is high.

Mechanical Method

1. This method is assisted by mechanical devices such as typewriters as recording tools, abacus, slide rudder, calculators, and cash register machines as counting tools.

2. Accounting tools are not an accounting method but are counting (or recording) tools that facilitate calculation work.

3. The effectiveness of the use of accounting tools in assisting in processing accounting data depends on the efficiency of the person handling the mechanical devices.

4. This method is suitable for medium-sized businesses such as wholesale business.

5. The advantages of mechanical methods compared to manual methods are the time of processing of accounting data and the accounting errors (counting errors) are reduced.

Electronic method

1. The more advanced data processing method is the electronic method that the computer uses.

2. The disadvantages and limitations of manual and mechanical methods lead to electronic methods. With electronic methods, accurate business information and updates can be quickly found using a computer.

3. This method is only suitable for large businesses because the cost of installation, hardware cost, and maintenance costs are very high. However, at present, computers are widely used in almost every business field.

Forms of Business Organization

There are three main forms of business organization, namely:

(a) Sole proprietorship

(b) Partnership

(c) Limited company

Sole proprietorship

1. This business is owned by an owner who invests money into the business as a capital.

2. Owners take care of their business or assisted by their family members or shop assistants.

3. Owners enjoy all the benefits and bear all losses.

4. Single owner liability is not limited. If business assets are insufficient to pay for

5. Examples of sole proprietorships are retail stores, service businesses such as laundry shops, barber shops, tailor shop, car workshop and professional services such as clinics, law firms, and accountants.

Sharing

1. Sharing is a business established by at least 2 partners who do business for profit.

2. The number of members for each type of partnership is summarized in the following table:

| Type of Partnership | Number of Members (Partners) | |||||||||||||||||||

| Minimum | Maximum | |||||||||||||||||||

| Ordinary Shares | 2 | 20 | ||||||||||||||||||

| Joint Service Partnership | 2 | No limit | ||||||||||||||||||

| Bank share | 2 | 10 | ||||||||||||||||||

| Characteristic | Private Limited Company | Public Companies Limited |

| Number of members | 2 to 50 people | At least 2 people but no maximum |

| Capital | From private person | From public person |

| Company share | Not listed in stock exchange | Listed in stock exchange |

| Transfer of shares | With the consent of the other shareholders | Free. No need to consent from other shareholders |

| Business life | Life is affected by the death or retirement of a shareholder | Life is not affected by the death or retirement of a shareholder |

| Company management | Shareholders may participate directly in terms of management | Shareholders may not participate directly in terms of management |

Reasons to Study Accounting

Own use

Accounting knowledge can help an individual:

(a) Planning and controlling his personal expenses and his family’s expenses later.

(b) Cultivate noble values such as careful, responsible, honest, systematic, and rational minded.

Business use

Accounting knowledge can help traders in the following aspects:

(a) Managing its business more efficiently.

(b) Strengthening business position financially.

(c) Designing a more effective business strategy.

Job use

Accounting knowledge creates an individual’s job opportunities in various economic sectors such as:

(a) industry, finance, banks, and trade sectors.

(b) government sector, public accounting firm and management.

(c) professions such as auditors, accountants, business executives, tax consultants, and others who have good prospects.

Purpose of furthering the lesson

A person pursuing further education to a higher level in the accounting field may choose to obtain:

(a) Degree in accounting from domestic or foreign universities.

(b) Professional qualification by passing the examination conducted by professional accounting bodies such as the Chartered Association of Certified Accountants – CACA and Chartered Institute of Management Accountants – CIMA.

Definition and Objective of Accounting and Bookkeeping

BOOKKEEPING

Bookkeeping is a record of financial transactions that involve money to be documented accurately and systematically based on the double entry system. The aims of the bookkeeping are as follow:

(a) Record, classify and summarize all business transaction in money value.

(b) As a record of the assets, liabilities, and equity of the business owner in order to know the financial position of the business at any given time

(c) Provide information about:

i. the type and amount of his

(d) Be evidence that a business transaction has taken place.

ACCOUNTING

Accounting summarizes the broader scope of the bookkeeping. Accounting is the process of providing financial information about a business to help traders decide. Accounting includes:

(a) Record transactions accurately and systematically.

(b) Classify, analyze, interpret, and report accounting information to help internal and external users and external users decide

(c) Planning and controlling business activities.

The purpose of accounting is to provide useful information to the following users: