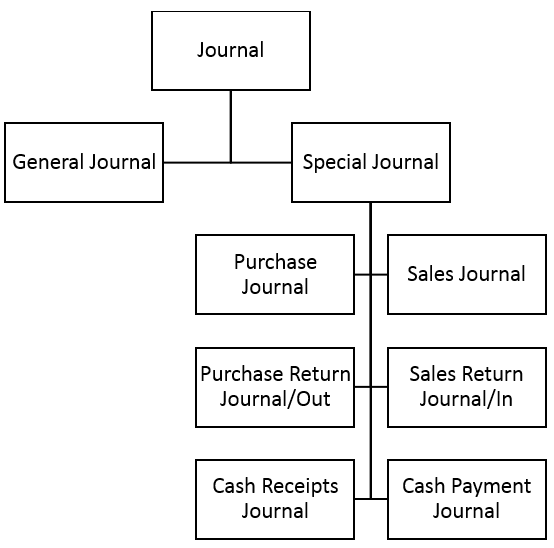

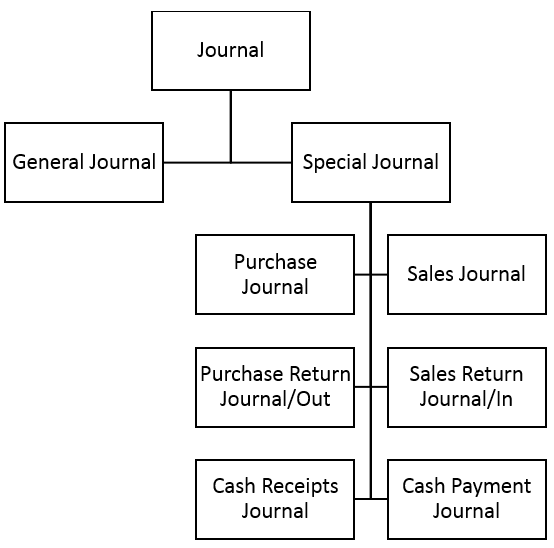

The types of journals are as follows:

The types of journals are as follows:

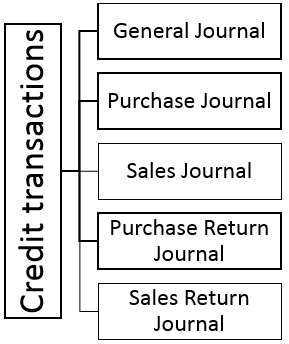

5. Credit transactions recorded in General Journals, Buy Journals, Sales Journals, Buy Return Journals, and Sales Payments Journals.

1. Business documents are the source of information to be recorded in the Books Of Original Entry

2. Subsequently, posting into the ledger is made and the final Financial Statement can be provided to determine the outcome of the business operation.

Document → Books Of Original Entry → Ledger → Financial Statement

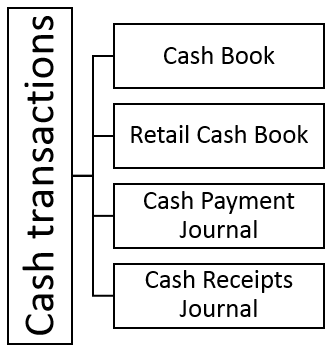

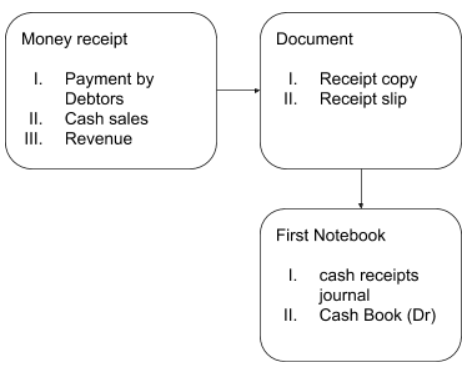

Receipt(Copy) As Information Sources For Cash Account Journal/Cash Book

1. When the business receives money from the debtor, cash sales and various outcomes, the original receipt will be given to the payer. Information from copy receipts is used to record in the Cash Receipts Journal or Cash Book.

2. Businesses that use cash register machines issue receipt slips or cash register slips for cash sales. This slip specifies the code of sales and receipts.

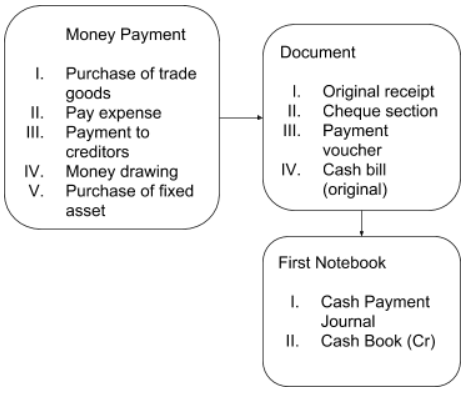

Cheque Section as information source for Cash Payment Journal/Cash Book

1. Information for Cash Payment Journal / Cash Book can be obtained from:

(a) Receipt (original) received for payment of money.

(b) Cheque section in cheque book

(c) Cash (original) bill and payout

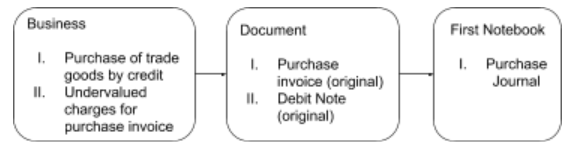

Puchase Invoice As Purchase Journal Information Sources

1. Information for Purchase Journal is available from:

(a) Purchase invoice (original) received from suppliers

(b) Debit notes (original) received from creditors when the original invoice is underdeveloped

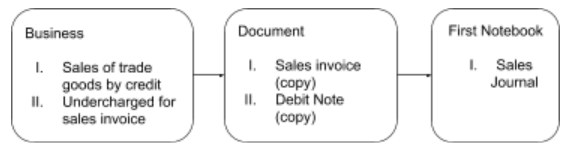

Sales Invoice As Source Of Journal Information Sour

1. The information in Sales Journal is obtained from:

(a) A copy of the sales invoice sent to the debtor

(b) A copy of the debit note which serves as an additional invoice when a sales invoice sent to the debtor is under delivery.

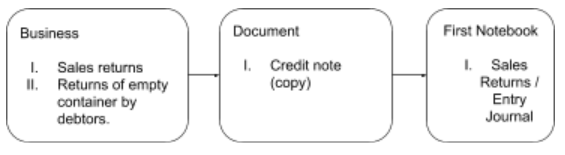

Credit Note (Copy) As Information Sources For Sales Return Journal

1. Information in the Sales Return Journal (In) is obtained from a copy of a credit note. The original credit note was sent to the customer when the goods were returned to the business.

Various Business Document As Account Records Source

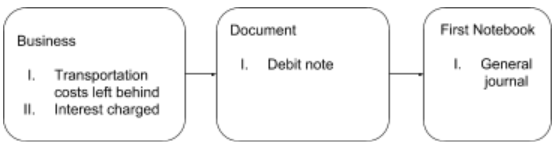

Debit Notes

1. Debit notes are also used as sources of information for General Journals.

1. The transaction is said to be complete after payment is made and the receipt issued as proof of payment.

2. The transaction is said to be complete after payment is made and the receipt issued as proof of payment.

Quotation Letter

The buyer sends a question letter to the seller for information about:

Quotes the items to buy.

Purchase Items:

i) Method of delivery

ii) Methods of payment

Buyer → Quotation Letter → Seller

Answer Letter

Sellers reply to buyers’ queries by including quotes and catalogs.

Seller → Answer Letter + Catalog → Buyer

Purchase Order

The buyer sends a purchase order to the seller to order the items officially.

Buyer(copy) → Purchase order → Seller(original)

Delivery Note

1. The seller sends a delivery note to the buyer along with the items ordered.

2. The buyer checked the items to confirm:

(a) All items received are items ordered in the purchase order

(b) All items in the delivery note were received in good condition.

Seller(copy) → Delivery Note + Item → Buyer(original)

Invoice

1. The seller provides an invoice based on a copy of the delivery note that has been verified by the buyer.

2. The invoice is then sent to the buyer to notify them of the total price of items they need to pay.

3. Typically invoices are provided in three copies:

(a) The original invoice is kept by the buyer to be recorded in the Purchase Journal.

(b) The first carbon copy is attached to the check when payment is made.

(c) Second carbon copy is kept by the seller for reference.

Seller (copy of the second invoice) → Invoice

Buyer → Cheque+Copy of first invoice → Seller

Debit Note

1. The seller sends the debit note to the buyer to notify him that his account has been debited to add the amount in the invoice.

2. The debit note serves as an additional invoice.

3. Debit notes are sent to the buyer when:

(a) Original Invoice charged less (item is charged less).

(b) Notes left on the invoice (eg transportation costs, the interest charged, and commissions charged to buyers).

(c) Additional charges apply to buyers when there is an exchange of items.

(d) When charges for containers such as cans or bottles are not recorded on the invoice.

Undervalued invoice → Debit Note → Adding debts amount

→ Seller (copy) → Debit Note → Buyer (original)

Credit Note

1. The seller sends a credit note to the buyer to inform him that his account has been credited to reduce his debts (reducing the amount in the invoice).

2. Credit notes are sent to the buyer when:

(a) The buyer returns the damaged item, the wrong brand, or the item different from the item ordered.

(b) Buyers return empty containers and bottles.

(c) Buyer invoice is overcharged.

3. Credit notes are red so that they can be distinguished from other business documents.

Overcharged invoice → Credit Note → Debts amount reduced

Seller(copy) → Credit Note → Buyer (original)

Cheque And Cheque Section

1. Cheques are a simple and secure payment method.

2. The buyer fills out the payment details on the check section. The detail to the check section is then used to be recorded in the Cash Book.

3. The seller also receives cheque and transfers into his bank account.

Buyer (cheque section) → Cheque → Seller (cheque)

Receipt/Copy Of Receipt

1. When a seller receives a payment from the buyer, the seller will send the receipt to the buyer as proof of receipt of payment.

Seller (copy) → Receipt → Buyer (original)

2. Receipts are usually provided in two copies:

(a) Original copy sent to the payer to be recorded in the Cash Payment Journal / Cash Book (credit).

(b) Copies of carbon/counterparts are retained by the seller for recording in the journal Cash Receipts / Cash Book (debit)

Account Statements

1. The Account Statements sent by the seller to the buyer. Account Statements is a summary of the transactions that occurred between the seller and the buyer, usually for a month.

Seller → Account Statements → Buyer (original)

2. The Account Statements also serves as a reminder to the buyer to settle the debt as well.

3. The buyer can check and compare the entries in his book with the item on the statement of account.

Memo

1. Office memos are usually used to record transactions that occur between business owners and their businesses. Memos serve as an internal document.

2. Typically, office memos are used to record:

(a) Money recruitment, merchandise, and assets by business owners.

(b) The admission of money and the owner’s personal assets into the business to increase its modal.

(c) Various things that can not be recorded in other First Notebook.

Cash Bills

1. This bill is used for cash transactions.

2. The seller will give a bill to the buyer who pays cash or

Payment Voucher

1. The payment voucher records all types of payment by the business side either in cash or by check. For example, paying employees’ salaries, rental of premises, and other business expenses.

2. The payment voucher contains:

(a) Payment details

(b) The amount of the payment (and whether paid in cash or check)

(c) Recipient’s signature

(d) Signature of manager

1. Business documents are

2. Information in business documents is the basis for recording into the Books Of Original Entry.

3. Business documents must be clear and complete and filed systematically for reference as necessary.

4. The types of local business documents are:

(a) Question Letter

(b) Answer Letter

(c) Purchase Order

(d) Delivery Note

(e) Invoice

(f) Debit Note

(g) Credit Note

(h) Check and Check Section

(i) Receipt

(j) Statement of Account

(k) Memo

(l) Cash Bills/Receipt Slip

(j) Payment Voucher

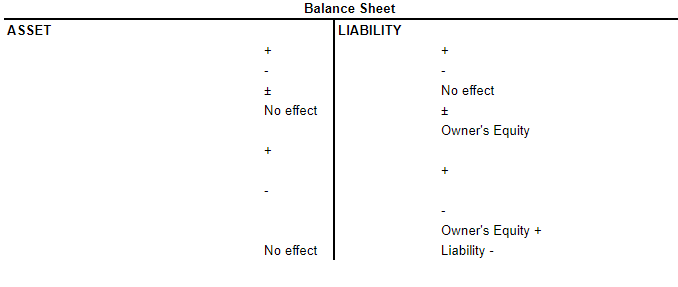

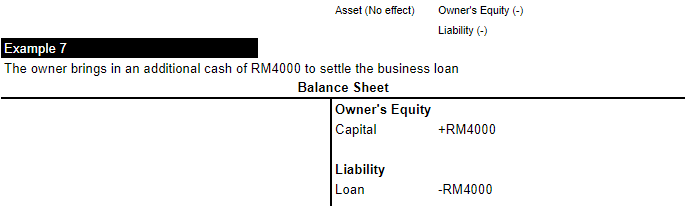

1. Basic accounting equations can be extended by incorporating the equity component of the owner, ie capital, revenue, and expenses as follows:

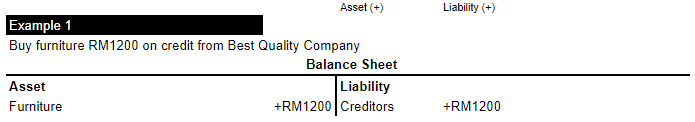

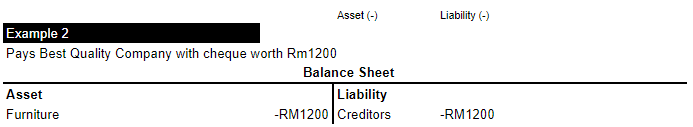

Example 1

| Business Transaction | Effect on | ||

| Asset | Liability | Owner’s Equity | |

| I. Buy goods worth RM300 in cash |

| ||

| II. Buy goods worth RM760 on credit | Stock (+RM760) | Creditors (+RM760) | |

| III. Sell items worth RM80 with cash at RM95 |

| Capital (+RM15)(Profit) | |

| IV. Sell items for RM360 on credit at RM400 |

| Capital (+Rm40)(Profit) | |

| V. Pay a fee of RM150 in cash | Cash (-RM150) | Capital (-RM150)(Loss) | |

| VI. Pay the loan interest of RM95 in cash | Cash (-RM95) | Capital (-RM95) | |

| VII. Receive a commission of RM55 in cash | Cash (+RM55) | Capital (+RM55)(Profit) | |

| VIII. Pay creditors with checks of RM420 and receive a RM80 discount. | Bank (-RM420) | Creditors (-RM500) | Capital (+RM80)(Profit) |

| IX. The receivables pay with a check worth RM810, giving him a RM90 discount |

| Capital (-RM90)(Loss) | |

| X. Take Rm90 worth of goods for your own use | Stock (-RM900) | Capital (-RM90)(Drawing) | |

| XI. Get a loan from a bank of RM6000 | Cash (+RM6000) | Loan (+RM6000) | |

| XII. Business owners bring in a table from his home worth RM75 for business use | Furniture (+RM75) | Capital (+RM75) | |

| XIII. Checks from debtors of RM350 are not entertained by banks. |

| ||

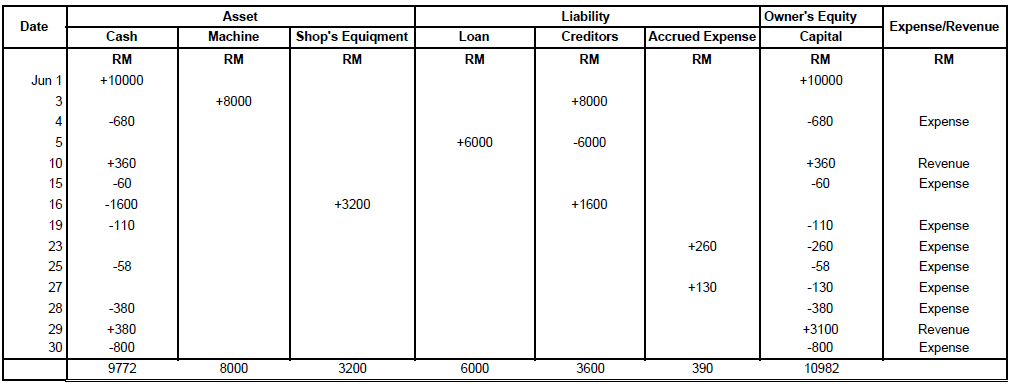

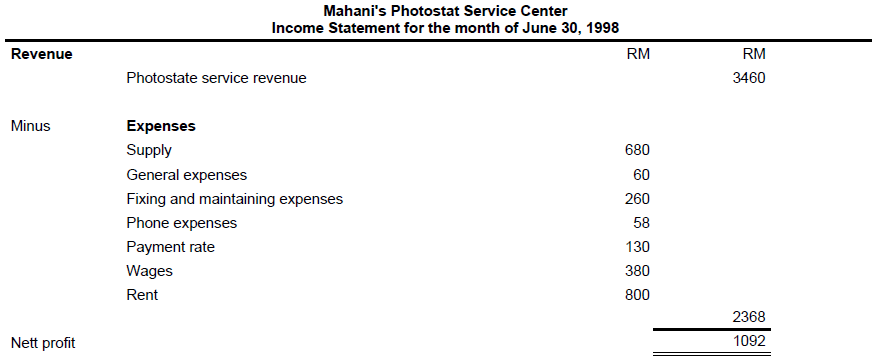

Example 2

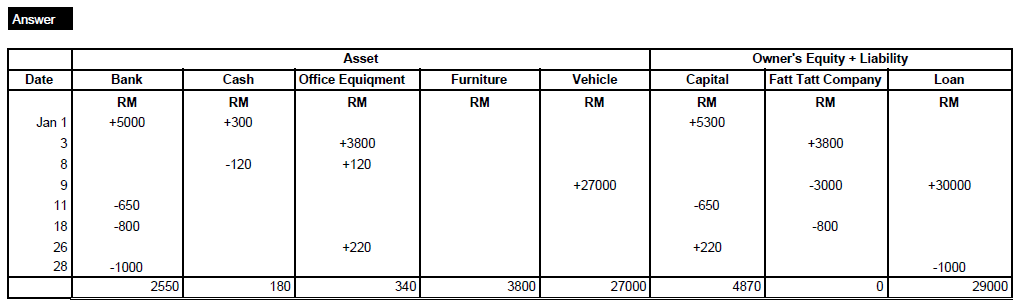

Mahani operates a photostat service center. The following is a business transaction during June 1998.

June 1 Mahani brings in cash Rm10000 to start his business.

3 Purchase two photocopiers on credit at RM4000 per unit.

4 Purchase a supply of RM680 in cash.

5 Obtained a bank loan of Rm6000 to settle the debts to creditors of photocopier machines.

10 Received RM360 from photostat service.

15 Paying for general expenses of RM60 with cash

16 Purchase shop equipment worth RM3200. Half of them are paid in cash and the balance will be paid next month

19 Pay your own retail expenses with business cash of RM110.

23 Accepts an RM260 bill to repair and maintain a photostat machine.

25 Paying a phone bill of RM58 for cash.

27 Received electricity and water bills of RM130 for June.

28 Paid a shop assistant’s salary of RM380 with cash.

29 Received RM3100 from photostat service.

30 Pay rent in cash RM800

(a) Record the transaction using the format of the column showing the types of assets, liabilities, and owner equity. Summarize those items on June 30, 1998.

(b) Prepare Income Statement for the month ended 30 June 1998.

1. When a transaction occurs, the position of the assets, liabilities

Revenue

1. Revenue is the money it receives or will be received by the business at an upcoming date, from

2. There are two types of revenue, namely:

(a) the revenue of business conduct

(b) non-operating revenue

3. Revenue of business conduct in relation to the main business activities, namely:

(a) sale of merchandise (trading business)

(b) the outcome of a given service (business service)

4. Non-business revenue is unrelated to the main business activity, for example:

(a) savings interest

(b) rent received

(c) dividends received from investments

(d) profit from the disposal of fixed assets in use

5. The principle of profit sharing is:

6. Revenue will add equity to business owners.

Expenses

1. Expenses

2. An imbalance expense has occurred when the expense is used to earn revenue within a period of accounting, regardless of whether the expenses have been paid or not.

3. There are two types of expenses:

(a) business operating expenses

(b) non-expenses business conduct

4. Business expenses are expenses incurred in conducting daily business transactions, such as rent paid, salary, electricity, and water (rates), transportation expenses, insurance, telephone expenses, general expenses, stationery, advertising, etc.

5. Non-business expenses is an expense that is unrelated to the usual daily routine of a business, such as a bank loan interest, loss on sale of used fixed assets, and losses caused by natural disasters or unforeseen occurrences such as floods, fires, thefts, etc.

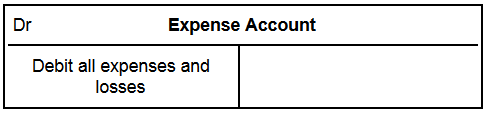

6. The entry principle for expenses is:

7. Expenses will reduce owners’ equity.

Assets

1. Assets are property owned by a business and used to carry on business activities.

2. Assets are divided into two types, namely:

(a) fixed assets

(b) current assets

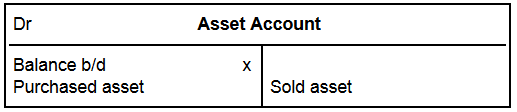

Fixed Assets

1. Fixed assets are assets that are durable and can be used for some accounting periods. For example, premises, vehicles, machines, office equipment, furniture, fixtures and accessories, and so forth.

2. Fixed assets are not for resale for profit. This asset is used to help run a business.

3. The notes principle for fixed assets is:

Current Assets

1. Current assets are assets that can be converted into cash within the longest between one accounting period or one year.

2. Examples of current assets are stocks of merchandise, stationery stocks, supplies stocks, debtors, cash in banks, cash in hand, past expenditure, and accrued revenue.

3. Current assets have always changed their form and value in an accounting period.

LIABILITY

1. Liabilities are the liabilities of the business side to the outsider and need to be settled by money, goods, or services.

2. Liability is a claim to a business asset as the lender to the business is entitled to claim payment from the business.

3. Liabilities can be divided into two types, namely:

(a) Long term liability (> 1 year)

(b) Current liabilities (< 1 year)

Long Term Liability

1. Long term liabilities are business payables that are not repayable within a year or an accounting period.

2. Examples of long-term liabilities are secured loans, loans, and mortgages.

Current Liability

1. Current liabilities are business payables that are repayable within one accounting period or a year.

2. Examples of current liabilities are bank overdrafts, creditors, accrued expenses, and past revenue.

Owner’s Equity

1. The owner’s equity is the liability of the business side to its owner. This is because business owners lend money to businesses as capital to start their business.

2. Owners’ equity included:

(a) the capital invested by the owner into the business (initial investment and additional investment)

(b) net profit because of profitable business activities

3. Capital investment by the owner and net profit will increase owner’s equity while the uptake and loss will reduce the owner’s equity. Observe the following formula:

Early Capital + Nett profit – Drawing = Final Capital

Early Capital – Nett loss – Drawing = Final Capital

4. The owner’s equity is the owner’s claim on the business assets.

5. Owner’s equity resources can be found through a variety of ways, depending on the type of business organization:

| Types of Business Organization | |

| Sole proprietorship |

|

| Partnership |

|

| Limited company | The money collected from the issuance of shares to shareholders and the public |

6. If the business asset is contributed by its owner, the accounting equation is as follows:

Asset= Owner’s Equity

7. If business assets are contributed by its owners and other lenders (liabilities), then the accounting equation is as follows:

Asset = Owner’s Equity + Liability

or

Owner’s Equity = Asset – Liability

or

Liability = Asset – Owner’s Equity

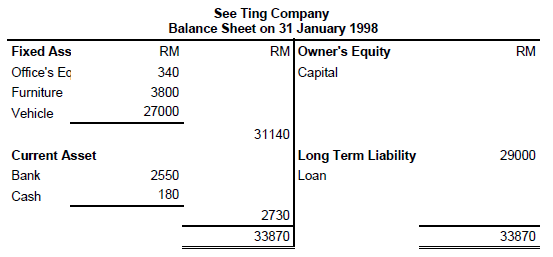

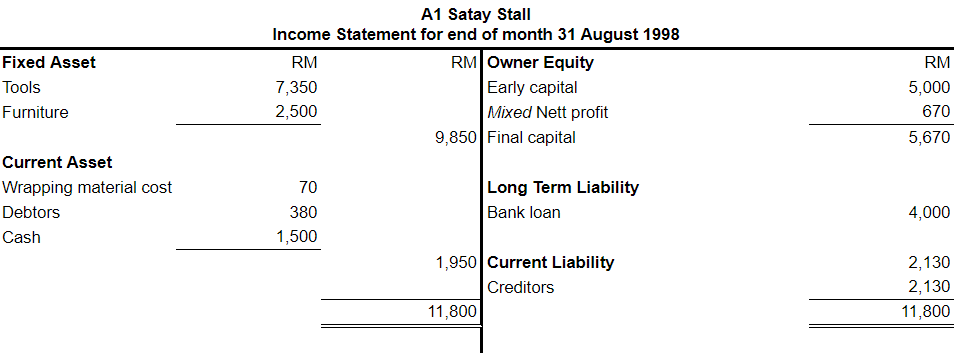

Balance sheet

1. Balance sheet indicates the following items on a particular date:

(a) the financial position of the business

(b) the position of assets, liabilities, and capital invested by the business owner (owner equity)

2. The Balance Sheet has the following:

(a) the name of the business

(b) the title of the statement

(c) the date of the return

3. Both Balance Sheets are balanced as the total assets are equal to the total liabilities of owners equity.

Assets = Liability + Owner Equity

1. Income Statement summarizes the effects of business activity for an accounting period whether the profit or loss is earned for that period.

2. Income statements have two main components:

(a) results

(b) spending

3. Nett profit is earned if revenue exceeds expenses while net loss occurs when expenditure exceeds revenue.

Revenue > Spending → Net Profit

Revenue < Expenses → Net Loss

The Income Statement has the following information:

(a) the name of the business

(b) the title of the statement

(c) the accounting period for the relevant statement

4. The Income Statement has the following information:

(a) the name of the business

(b) the title of the statement

(c) the accounting period for the relevant statement

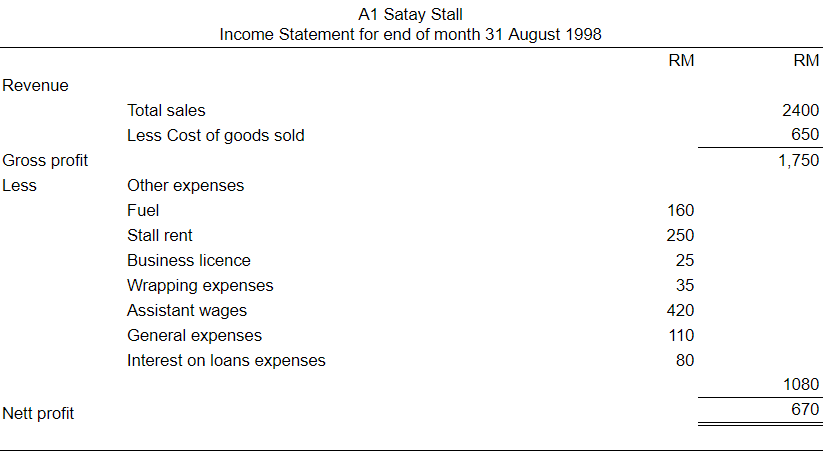

Example:

The following is the information provided by Khalid who manages the A1 Satay Stall.

| Total amount of sales for August 1998 | RM2400 |

| Material cost used (meat, cucumber, onion, etc.) | 650 |

| Other expenses in August: | |

| Fuel | 160 |

| Stall rent | 250 |

| Business licenses | 25 |

| Wrapping expenses | 35 |

| Assistant wages | 420 |

| General expenses | 110 |

| Interest on loans expenses | 80 |