Purpose Of Providing Trade Accounts And Profit Loss Accounts

1. Trading account and Profit Loss Account is a finishing account because both accounts are provided at the end of an accounting period based on information in the estimated balance.

2. The Trading Account is provided to determine the gross profit or loss of the business at the end of the accounting year.

(a) Gross profit (or loss) is earned before consideration of expenses and business operating results.

(b) Gross profit is recovered if net sales exceed sales costs while gross loss is recovered if the cost of sales exceeds net sales.

Gross profit = net sales – sales costs

Gross loss = cost of sales – net sales

3. Profit Loss Accounts are made for profit or loss at the end of the accounting period.

(a) Net gains (or losses) are arrived at after the gross profit (or loss) plus revenue and deduction of operating expenses for an accounting period. (b) Net profit is obtained if the gross profit plus the amount of revenue exceeds the operating expenses.

Net profit = gross profit + revenue – expenses

(c) Net loss is recovered if operating expenses exceed the gross profit plus yield.

Net loss = expenses – (gross profit + revenue)

(d) Net loss is also recovered if a gross loss plus operating expenses exceeds operating profit.

Net loss = loss + expenses – revenue

Author: Franco

Balance Sheet

Definition of Balance Sheet

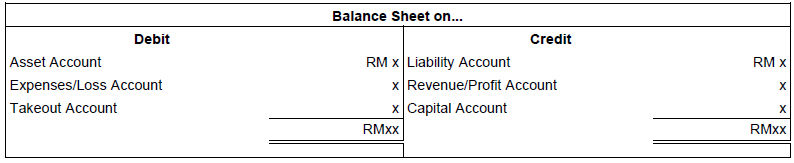

1. Balance Sheet is a list of debit and credit balances taken from ledger accounts and Cash Book on a particular date. Balance Sheet is not an account.

2. Balance Sheet can be safely provided, just hope to test the accuracy of double account records in the ledger and Cash Book.

3. Guides provide

(a) All outstanding balance of the

(b) All credit balances in the ledger and Cash Book are recorded on

4. In conclusion, debit and credit balances in the Balance Sheet are listed as follows:

Objective Of Balance Sheet Preparation

1. Check the accuracy of the following aspects:

(a) calculations in Books of Original Entry to Ledger.

(b) posting from the Books of Original Entry to the Ledger.

(c) record transactions based on double-entry systems.

2. Easy to prepare the Income Statement and Balance Sheet.

Limitations Of Balance Sheet Used

1.

2. There are several types of mistakes that do not affect the balance of

3. A balanced Balance Sheet may have the following errors:

(a) Error omitting a transaction.

Direct transactions are not recorded in any book

Example:

Balance Sheet is still balanced even though no entry is made in the Takeout Account and Purchase Order. In this case, the amount of each debit and credit for Balance Sheet recorded is less than RM150.

(b) Principle Error

Details recorded in the wrong type of accounts (modal expenses is recorded as revenue expenses and so on)

Example:

The cost of repairing the roof of the premises is RM460 in

Balance Sheet is still balanced because the amount of Debit was not affected.

(c) Commissions Error

Details recorded in wrong individual account

Example:

Purchase from Jasni is worth RM180 and has been credited into

Trial Balance is still balanced because the amount of credit was not affected.

(d) Original Record Error

The error of amount from the First Entry Book is posted to the ledger.

Example:

Purchase from Mohandas Company RM306 is written as RM360 in the Purchase Journal. During posting to Ledger, the amount of RM360 is debited in the Purchase Account and credited to Mohandas Company.

In this case, the amount of each credit and debit for Trial Balance recorded is more as much as RM54. The Balance Sheet is still balanced.

(e) Offense Error

The debit error of an account is offset by the same mistake of amount for other account credits and so on.

Example:

The purchase is below RM250, as well as an understated sales of RM250.

Amount of each debit and credit for Balance Sheet recorded is understated as much as RM250. The Balance Sheet is still balanced.

(f) Inverse Error

Transactions are recorded in the correct account but on the wrong side. The account that should have been debited has been credited and so on.

Example:

Check received worth RM1200 from Kok Leong have been incorrectly debited in Kok Leong’s account and credited to Bank Account.

In this case, only doubled-entry reversed. Debit and credit amount are not affected. The Balance Sheet is still balanced.

4. The imbalanced Balance Sheet may also have the following mistakes:

(a) Incomplete double-entry

Forget to record the debit or credit for a transaction.

Example:

Buy furniture on credit from Firdaus Company RM850 is only recorded in the Furniture Account only.

In this case, the amount of credit for Trial Balance recorded is understated as much as RM850.

(b) Amount Error

The amount of the

Example:

Purchase an item from Theresa Company worth RM980 was recorded correctly into Purchase Journal but has been posted to Theresa Company Account by Purchase Ledger as much as RM890.

In this case, the amount of credit for Trial Balance recorded is understated as much as RM90.

(b) A similar transaction is recorded twice

A transaction was recorded twice for debit or credit.

Example:

Credit sales of RM960 to Virmala have been credited into sales account and Vimala Account.

In this case, the amount of credit for Balance Sheet recorded is more as much as RM960 meanwhile the amount of

(d) Error in Balance Sheet

i. Error in calculating the amount of

Example:

i. Withdrawal of RM80 is wrongly listed into credit for Balance Sheet.

ii. The RM880 bank overdraft is incorrectly listed into

For,

i. The difference of Balance Sheet is RM160 (Debit recorded is understated as much as RM80 and credit recorded is more as much as RM80).

ii.

The Ways To Detect Error

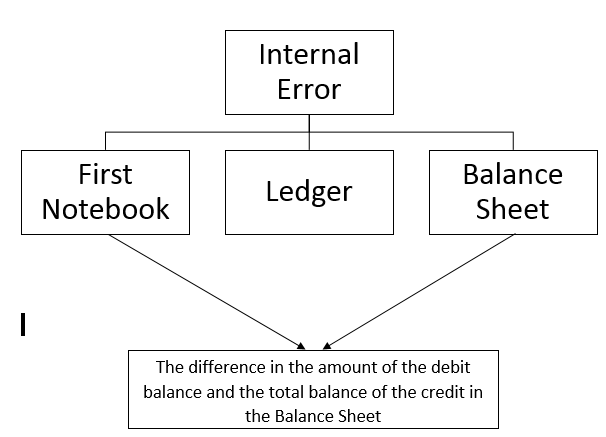

1. The difference in the amount of the debit balance and the amount of credit balance for the Balance Sheet may be due to an error or more error.

2. The error may

3. The following guide can be used to detect errors.

(a) Check the total debit amount and total credit on

(b) Find

(c) Divide the total difference into two, such as RM40 and find out whether there is an account that has the same amount in the Balance Sheet. If available, make sure the detail placed in the right place because of this mistake may be caused by the balance placed in the wrong place (debit placed into credit and so on).

(d) Check again to make sure all of the balance from Ledger Account has been listed in

(e) Check the Ledger Account and make sure that:

i.

ii. The amount inside the Books of Original Entry posted to the correct account and correct Ledger Account.

iii. All items were posted to certain accounts by ledger. Do not forget the discount space for cash book debit posted to Discount Given Account and discount space for cash book credit posted to Discount Received Account.

Ledger Distribution

1. Large businesses require more than one ledger to record transactions.

2. Ledger can be divided into three types namely General Ledger, Debtors Ledger (Sales Ledger) and Creditors Ledger (Purchase Ledger). Each type has the following special functions:

| Records all accounts except for debtors merchandise and creditors merchandise. (General ledger also records assets and creditors of assets).) | |

| Records debtors account transaction only. | |

| Records debtors account transaction only. |

3. Debtors Account and Creditors Account contains many entries, therefore both accounts are separated from the General Ledger and saved in a small ledger.

4. The purposes of Ledger Distribution are

(a) To make sure the recording work can be distributed to some clerks so that every clerk is responsible for keeping one ledger only.

(b) To facilitate the reference because each ledger has a specific account.

(c) To control mistakes and facilitate mistakes detected as different clerks are assigned to take care of certain ledger books.

(d) To improve quality and recording efficiency.

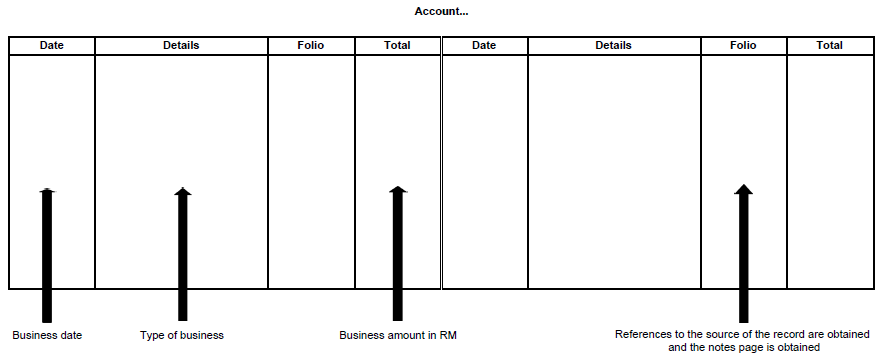

Folio

1. Folio space is filled during posting (transfer of entries) from one book to another.

2. Folio space that is still blanking means that the post has not been created yet.

3. The practice of recording folio numbers in the folio columns can reduce error as well as the loss of transaction entries.

4. During posting,

(a) Folio columns in the journal filled with Ledger Account pages that receive posting from the earlier Journal.

(b) Folio columns in Ledger Account filled with Journal pages from which posting made.

Balancing And Closing Account

- All accounts must be balanced or closed at the end of the accounting period

- (a) Balancing the account means mixing both sides of the

debit and credit of an account to find the difference between the totaldebit with the credit amount of the account.

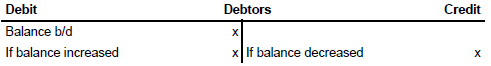

(b) If the debit amount exceeds the credit amount, the remaining h / b is next to the credit.The balance b / d at the beginning of the following month will be next to thedebit . This account is said to have a debit balance. For example, Asset Account, Debtors account, Takeout Account and Expenses Account.

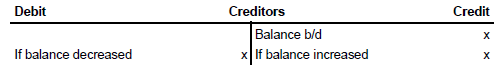

(c) If the credit amount exceeds the debit amount, the remaining c / d is next to thedebit . The balance b / d at the beginning of the following month will be located next to the credit. This account is said to have a credit balance. For example Creditors Account, Capital Account, Liability Account, and Revenue Account.

i.

iii. Debtors

iv. Expenses

Account with CREDIT Balance

i. Liability

ii. Capital

iii. Creditors

iv. Revenue

3. Closing an account means the difference between the amount of the

4. Closing an account means the difference between the amount of the

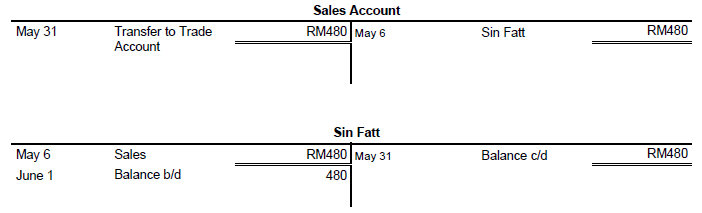

See this transactions:

May 6 Sell items worth RM480 to Sin Fatt.

Closing Revenue Account And Expenses Account

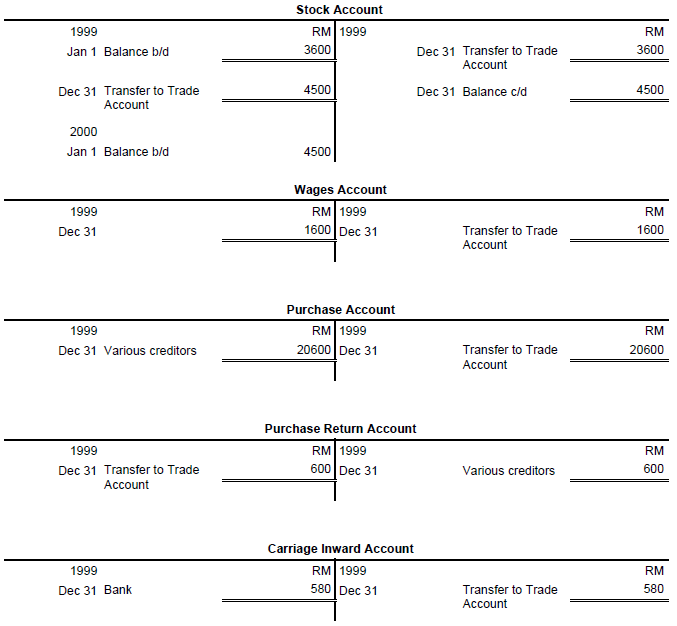

1. Revenue and expenses accounts are closed at the end of the accounting period by transferring the balance to the Ending Account (Trading Account and Profit Loss Account). This account has no balance at the end of the accounting period.

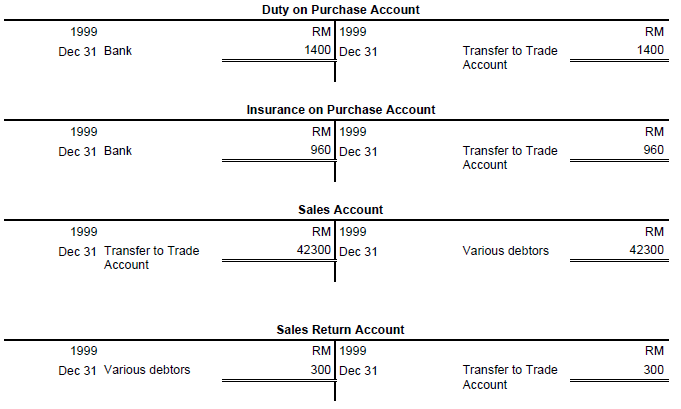

(a) Accounts that affect gross profit or gross loss are transferred to the Trade Account. For example, stocks, purchases, spending on purchases (inbound transport, on-the-job purchase, insurance on purchases, wages), returns on sales, sales, and sales returns.

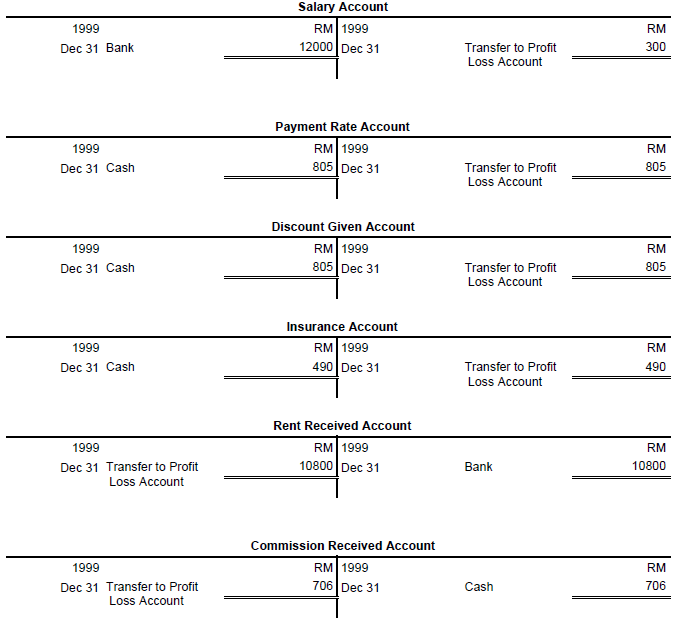

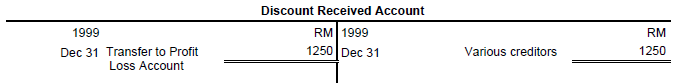

(b) An account that affects net profit or loss is transferred to the Profit Loss Account. For example, Expenses Account and Revenue Account.

2. The expenses accounts and revenue accounts are temporary or nominal accounts for one accounting period only because all expenses and revenues for one accounting period are not carried to the next accounting year.

3. The purposes of closing revenue account and expenses account at the end of accounting period are:

(a) To make sure both types of accounts will have zero balance at the beginning of each accounting period. (Revenue accounts and expenses accounts only collect information for one accounting period only.)

(b) To make sure Owner’s Capital Account can be updated. All revenues and expenses are transferred to the Profit Loss Account to calculate the net profit (or net loss) which is the difference between the amount of revenue and the amount of expenses. Then, this net profit or net loss is transferred to the Owner’s Capital Account.

– Net profit will increase the owner’s capital (owner’s equity)

– Net loss will reduce the owner’s capital (owner’s equity)

4. The closing account is done via General Journal and then posted to Ledger.

5. The accounts that affect gross profit (or gross loss) are closed by transferring to the Trading Account as follows:

6. The accounts that affect net profit (or net loss) are closed by transferring to the Profit and Loss Account as follows:

Record Into Ledger Account

Understanding Ledger

1. Ledger is the main account book to record business transactions. Various types of accounts are recorded in the following ledger:

2. Debtors Account and Creditors Accounts are used to record credit transactions with individuals or firms.

3. Debtors are people (firm) who are in debt with the business while the creditor is the person (firm) owed by the business.

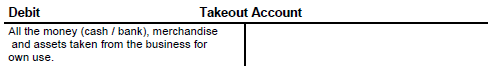

4. The take-up account records all goods, assets, and business money that the owner takes for his own use.

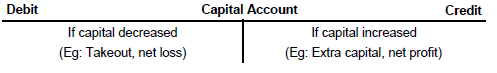

5. The Capital Account records all asset or the owner personal money brought into the business.

6. For the accounts of debtors and creditors, the word “Account” does not need to be written. Only the names of debtors and creditors are written. For example, Normah, Goldwin Company.

How To Record Transactions Into Ledger Accounts

Individual Account

1. Individual accounts are related to the Debtors Account, Creditors Accounts, Takeout Accounts

How To Record Individual Account

(a) Debtors

Example 1

May 2 Sales on credit to Mahendran RM2500

How To Record Individual Account

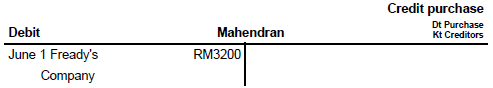

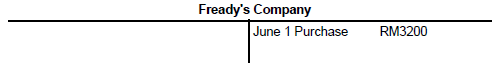

(b) Creditors

Basic principle of recording:

How to record transactions related to the Creditors Accounts

Example 1

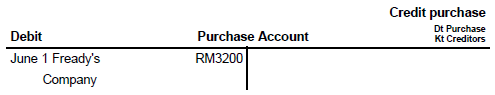

June 1 Buy goods on credit from Fready’s Company worth RM3200

(c) Takeout

Basic principle of recording:

How to record transactions related to the Takeout Accounts

The take-up account is always debited with business details issued for your own use.

How to record transactions related to Norin Book Store Takeout Account

(d) Capital

Basic principle of recording:

Non-individual Account

1. Non-individual accounts are used to record transactions that do not use the name of a firm or individual.

2.

(a) Real account (Asset)

(b) Nominal account

3. Real Account (Assets) records all properties (assets) owned by the business and used to help run a business. For example, premises, vehicles, furniture, office equipment, fixtures and fittings, machines, stocks, cash, and banks.

4. Nominal Accounts record all revenue and business expenses. Examples of revenue are commissions received, dividends received, discounts received, interest received, and rent received. Examples of expenses include payment rates, insurance, fares, paid rentals, advertising, discounts, stationery, salaries, and general expenses. In addition, purchase accounts, sales accounts, return inward account (or sales return), and return outward (or purchase return) accounts are also classified in the Nominal Account.

How To Record Nominal Account

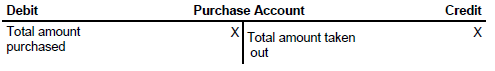

(a) Purchase Account

Basic principle of recording:

How to record transactions related to the Purchase Accounts

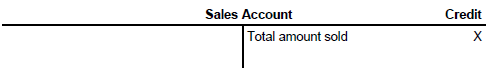

(b) Sales Account

How to record transactions related to the Sales Accounts

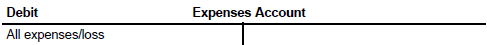

(c) Expenses Account

How to record transactions related to the Expenses Accounts

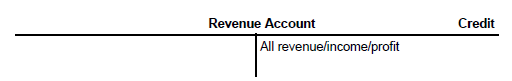

(d) Revenue Account

How to record transactions related to the Revenue Accounts

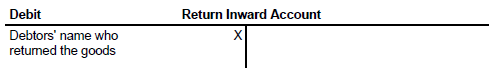

(e) Return Inward Account/Sales Return

How to record transactions related to the Return Inward Account/Sales Return

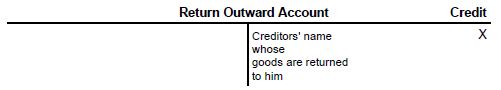

(f) Return Outward Account/Purchase Return

Basic principle of recording:

How to record transactions related to the Return Outward Account/Purchase Return

Guide To Recording Transactions Into Ledger Account

1. Transactions are recorded into the ledger in the order of the transaction date occurred.

2. All entries in ledger must be complete with

(a) Date

(b) Items

(c) Transaction value

3. For Asset Account (Real Account), the same asset type can be categorized and recorded in the same account. For example, Office Equipment Account records assets such as calculators, computers, fax machines, and typewriter machines.

4. The guidelines to record transactions in ledger is as follows:

(a) Identify the accounts that are involved in a transaction

(b) The account will be debited and other accounts (its partner) will be credited with the same amount.

(c) Record based on a double entry system in the order of dates.

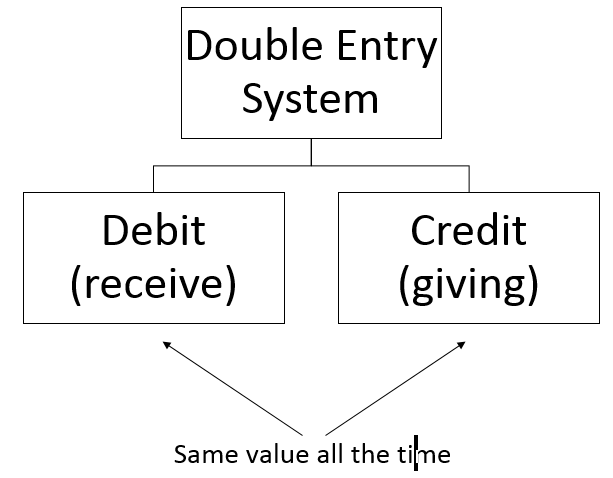

Double Entry System

Understanding of Double Entry

1. The double entry system is a system that records every business transaction into two separate ledger accounts with the same amount, one account is debited while the other account is credited with the same amount.

2

(a) When one party gives, there must be another accepting party

(b) When an amount is given, there must be the same amount is received

3. Then, the accounting principle of double entry system is

(a)

(b)

According to this system, the number of debit entries is equal to the total credit record at all times.

4. If a transaction involves an entry in two accounts only, the entry is recognized as an easy entry.

For example, selling goods worth RM300 to Edi on credit.

5. If more than two accounts are involved in a transaction, the entry is known as a compound entry. For example, Edi settles all its debts with check valued RM270.

Why Double Entry System Is Used

1. The double entry system is used to record business transactions for the following reasons

(a) The double entry system is a complete and systematic recording system, with the giving party and the receiving party listed.

(b) The double entry system allows the Trial Balance provided. Based on the Trial Balance, the calculation and accounting provisions can be ascertained. Furthermore, financial statements can be easily prepared to know the performance of the business.

(c) According to the rules of the double-entry system, each record is recorded twice.The debit amount must equal to credit amount at all times.This system can control scams and detect errors easily.

2. Ledger account has two parts, the left side is called debit and the right side is called credit.

3. An account is a summary of systematic and accurate transactions. The account is provided in the form of “T”.

4. All ledger accounts can be classified into two main categories, namely

(a) Individual account

(b) Non-individual account

Uses of General Journal

General journals are used to record:

(a) opening notes

(b) purchase and sale of fixed assets on credit

(c) take possession of the asset

(d) admission of assets and money to increase capital

(e) correction of errors

(f) closing entries

(g) transfer records

(h) miscellaneous things that can not be recorded in other journals

Opening Notes

1. The opening entry records the remaining assets, liabilities, and capital at the beginning of the accounting period.

2. All assets are recorded on the debit side whilst all liabilities are recorded on the credit side.

Asset → Debit

Liability → Credit

3. Capital sought with the following formula:

Capital = Assets – Liabilities

4. The amount of the debit must equal the amount of credit, regardless of the number of debit and credit items.

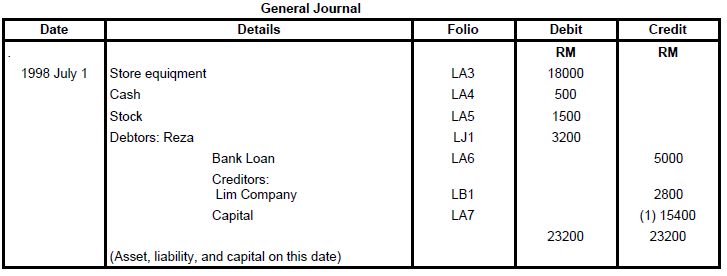

Example:

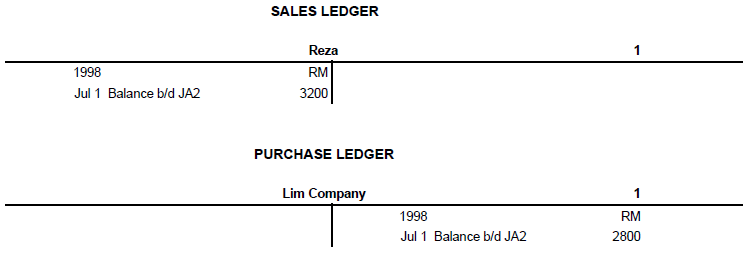

On 1 July 1998, Lily’s Business has assets and liabilities as follows:

Shop equipment RM18000

Cash RM500

Stock RM1500

Bank loan RM5000

Debtors: Reza RM3200

Creditors: Company Lim RM2800

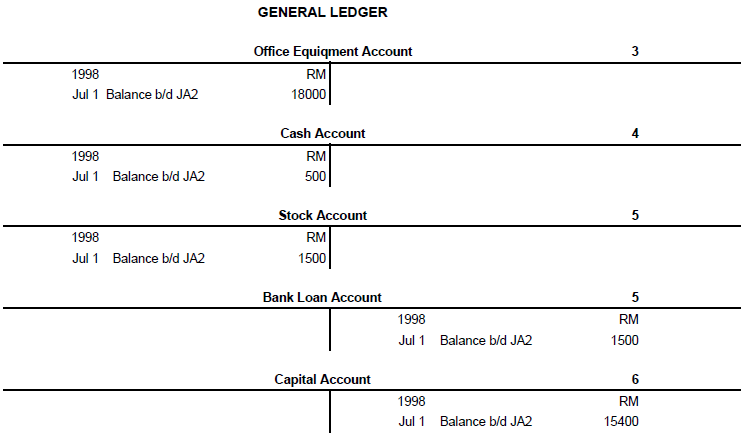

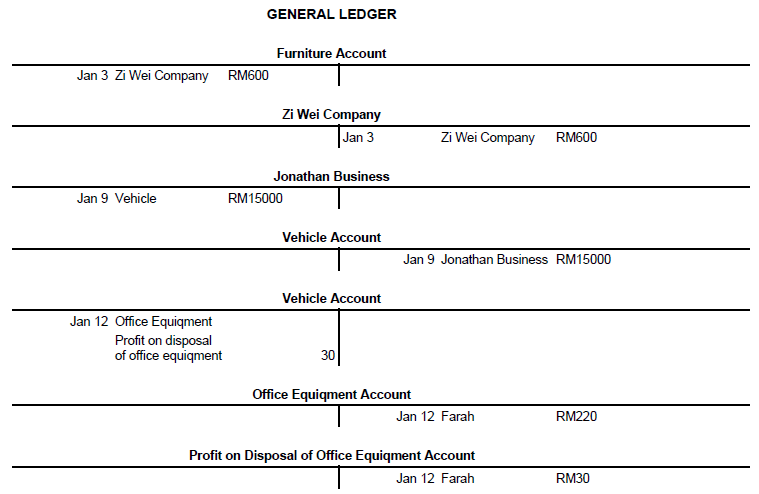

Posting Post Opening to Ledger

1. During posting to the ledger, the details next to the debit of the General Journal are posted to the side of the ledger account debit. Similarly, the details next to the General Journal credit are posted to the side of the ledger account credit.

2. All debtor’s accounts are recorded in the Sales Ledger or Debt Leader.

3. All creditor accounts are recorded in the Lejar of Purchasing or Leaning Payables.

4. All revenue, expenses, assets, liabilities, take-up and capital accounts recorded in the General Ledger.

5. Folio space records page references when posting is done between books.

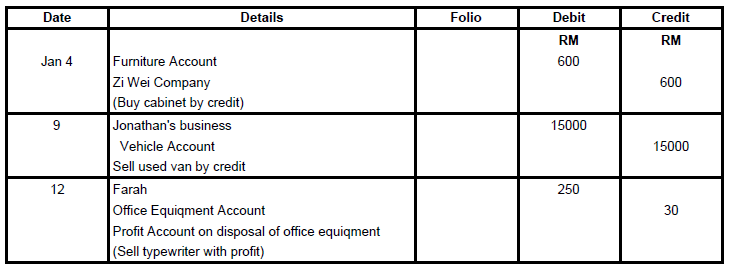

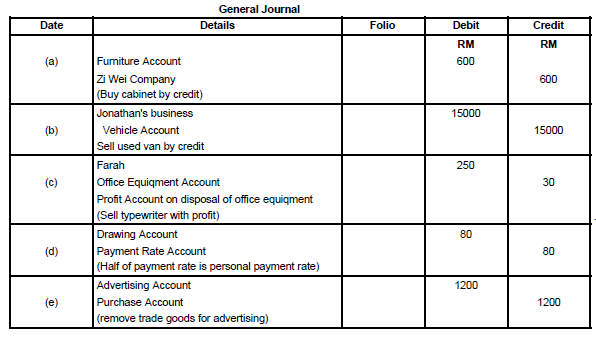

Purchase And Sale of Fixed Assets on Credit

January 3 Buy

9 A used van worth RM15000 is sold on credit to Jonathan’s Business.

12 A used typewriter with

Takeout of goods and assets

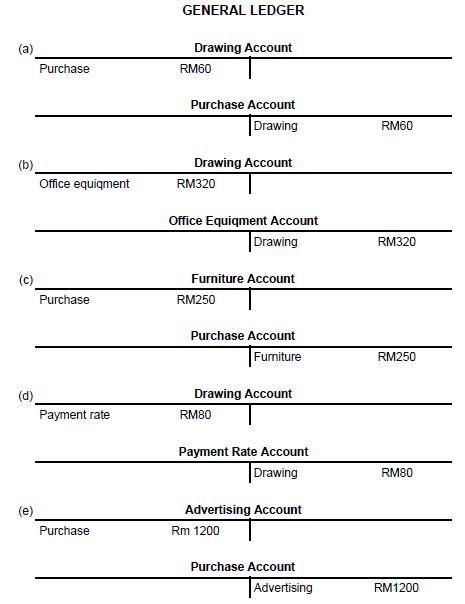

(a) Lim’s Book Store manufactures RM60 worth of stationery for personal use.

(b) Take a RM320 office typewriter for use at home.

(c) Salleh Furniture Store takes a cupboard costing RM250 from its stock for office use.

(d) Half of the payment amount paid at RM160 is the rate of payment for the residence.

(e) Johana Small Shop produces RM1200 worth of goods from her shop to be distributed as a free sample.

Admission of Assets and Money to Increase Capital

Example:

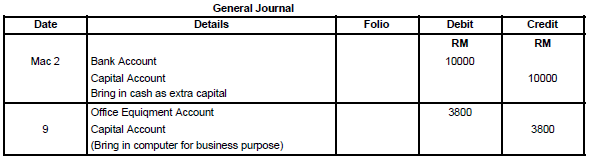

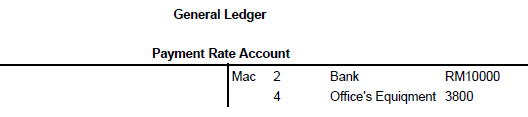

March 2 Transfer money RM10000 from personal Bank Account into business Bank Account as additional capital.

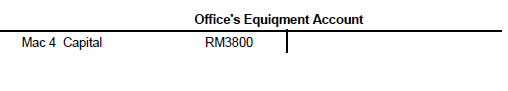

4 Bring in own computer worth RM3800 for business use.

Guide to Record in the General Journal

Example:

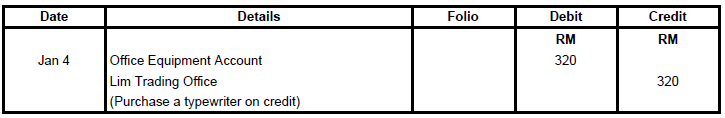

January 4 Buy a RM320 typewriter on credit from Lim Trading

1. Debit notes are recorded first, then followed by credit notes (credit notes should be written remotely from the edge).

2. The description of the transaction should be concise, compact, and written in brackets

3. Posts in the General Journal must contain:

(a) Date

(b) Item

(c) Amount

(d) Description

Forms Of General Journal

The form of the General Journal is as follows:

There are two types of posts in the General Journal:

(a) Easy note

Easy notes only involve a pair of double notes.

(b) Compound entry

Compound records involve more than a pair of double notes