1. Accounting cycle is a complete accounting process beginning with the occurrence of a transaction to the financial level.

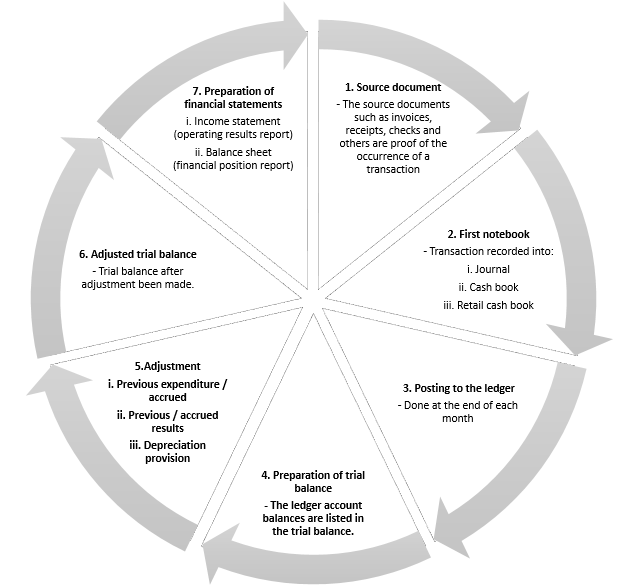

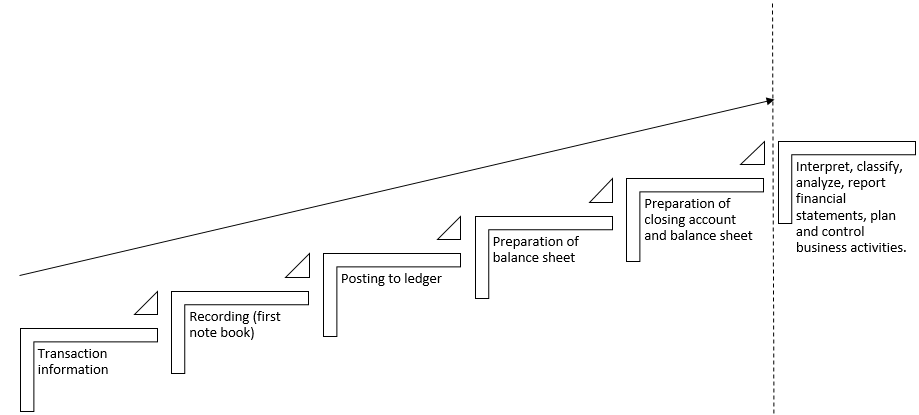

2. The accounting cycle can be illustrated through the flow chart below

3. Stages in this cycle are performed in a systematic order.

One accounting cycle is equivalent to the completion of one accounting period, and the next cycle will start at the beginning of the next accounting period.

4. The following table summarizes the accounting cycle.

| Accounting Cycle Stage | Document/Transaction Record | Recording Frequency |

| The source document as proof of the occurrence of a transaction | Source documents (invoices, checks, credit notes, debit notes, etc.) | Daily |

| Record transactions | Books of Original Entry | Daily |

| Post to ledger | Ledger | End of month |

| Preparation of balance sheet | Worksheet | End of month or end of the accounting period |

| Doing adjustment | ||

| Preparation of Ending Account and Balance Sheet | ||

| Preparation of Ending Account and Balance Sheet | Worksheet/financial statements | End of accounting period |

| Closing notes | General journal | End of the accounting period |

Timeline of Accounting History

3500 B.C.

– Earliest recorded at Babylonia.

– Clay sheets are used to keep records.

400 B.C.

– The discovery of papyrus(paper) and calamus(pen) in Egypt.

5th & 6th Century B.C.

– Money is used as an intermediary exchange.

850 A.D.

– The Hindu-Arab numeral system was introduced by Arab merchant who sailed to India.

14th Century

– Double entry system started in Venice, Italy.

– The year 1494 – Luca Pacioli published “summa” book which contains a part which related to double entry.

– Luca Pacioli designed a basics of accounting which in practice nowadays.

He is known as the father of accounting.

– Bookkeeping that based on double entry is also known as the Venetian Method.

18th & 19th Century

– The industrial revolution in England.

– Mass production – Cost accounting exists.

– Formation of a company – need to present financial reports – Financial Accounting exists.

– Accounting information is used by management to plan and manage the business more efficiently – Management Accounting exists.

20th Century

– Accounting field reaches a professional level.

– Accounting professional bodies are established.

– Accountants are subject to licensing rules, accounting code ethics rules of the accounting profession, and high academic qualification requirements.

– 1969 – Accounting Standards Committee established in England and Wales – issue a Standard Accounting Practice Statement to standardize accounting practices.

– 1973 – The International Standards Committee (I.A.S.C) was established in Sydney to enact International Accounting Standards (I.A.S) so that accounting practices are shared internationally.

Basic Accounting Concepts and Principles

1. Separate Entity

– separate businesses with their owners

– business dealings with its owners are regarded as an affair between two separate parties. Capital Account and Takeout Account are opened to record the affairs.

2. Money as Measurement

the transaction must be recorded in the form of money.

Limitations of this concept:

(a) Aspects that cannot be measured with money cannot be recorded.

(b) The value of the currency changes from time to time

3. Historical cost

– transactions are recorded based on the purchase cost at the date of purchase although the present value has changed.

– this concept is used to record assets in the Balance Sheet.

– The concept is held so that financial records are more objective.

4. Body persist

– businesses are assumed to have a continuous life and are not dissolved in the short term.

– Business assets will continue to be used to generate income for the business.

5. Matching concept / Accrual concept

– the amount of revenue in a certain amount must be matched with expenses during the same period for profit or loss during the period.

– all past and past accruals and expenses will be taken into account when seeking profits or business losses

6. Double entry principle

– each transaction is recorded in two separate accounts on the opposite side of the same amount.

– according to the principle of double entry, when a transaction is recorded, the total amount of debit entries must equal the total amount of the credit record of the transaction.