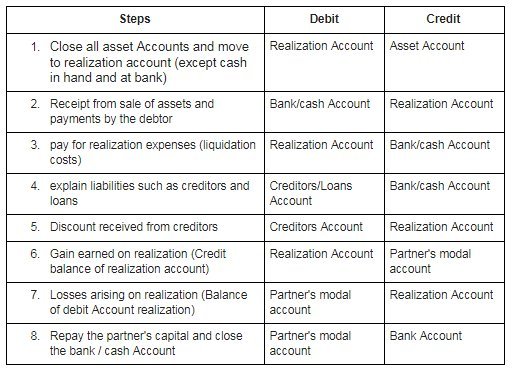

The steps to record the dissolution of the partnership are as follows:

Liability Required By Share

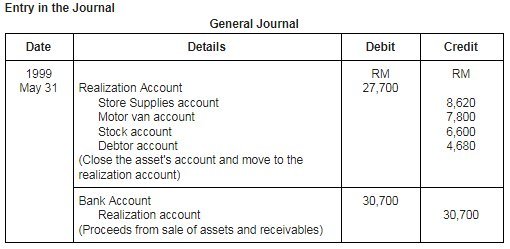

- When a partnership is disbanded, liabilities such as loans and creditors may be taken over by the partner.

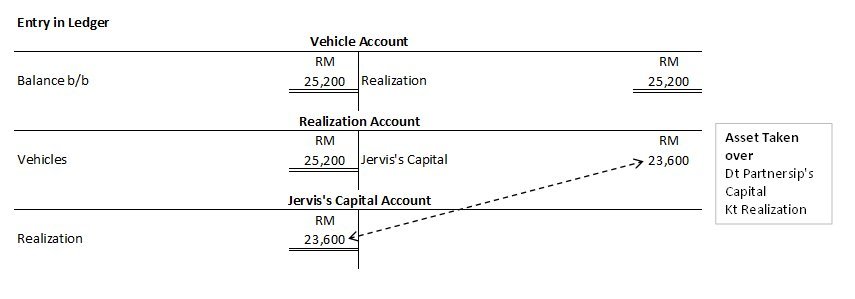

- Note to record the liability taken by the partner is:

Liability Debit Account

The partner’s modal credit account

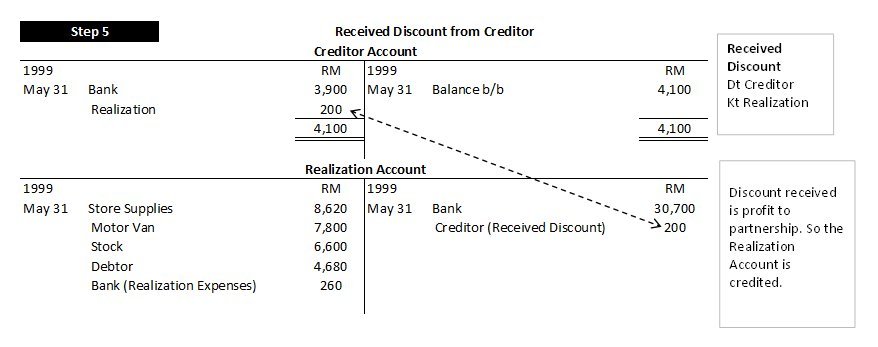

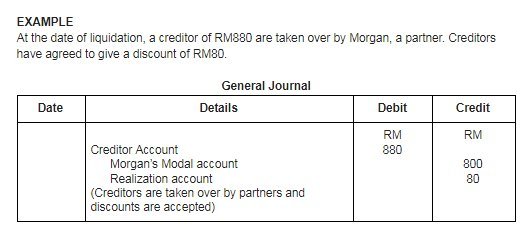

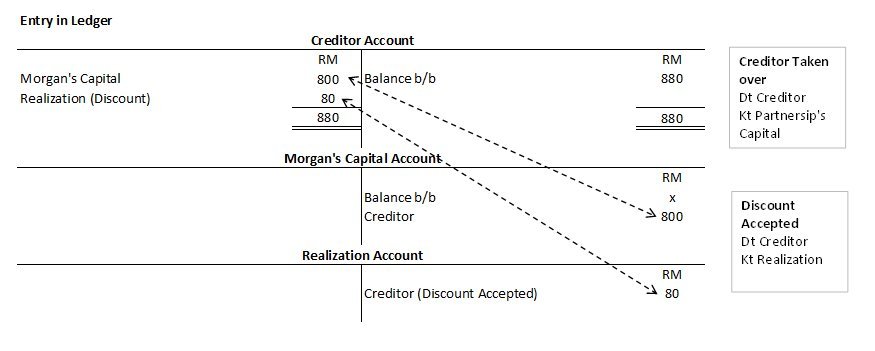

- If liabilities, such as creditors are taken over and discounts are received,

Debit of creditors’ account (with book value of creditors)

Credit of partner account (at deductible value)

Credit account of realization (discount received)

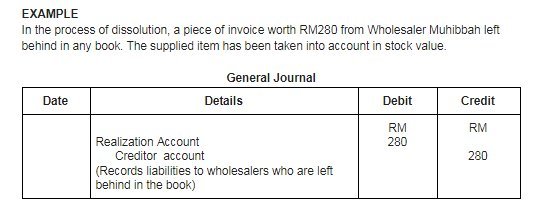

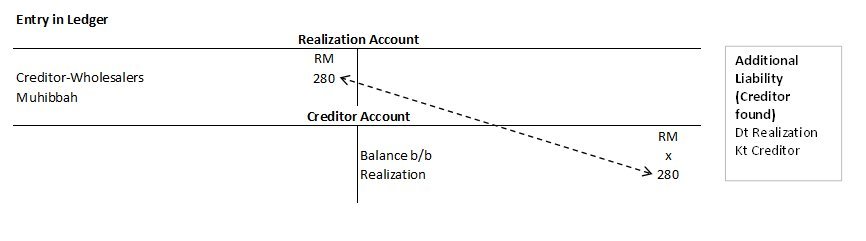

Additional Liabilities

- When the partnership is disbanded, it is possible that additional liability is found and not yet recorded in any book.

- The record for recording additional liability found is:

Realization Debit Account

Liability Credit Account

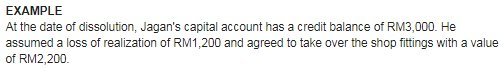

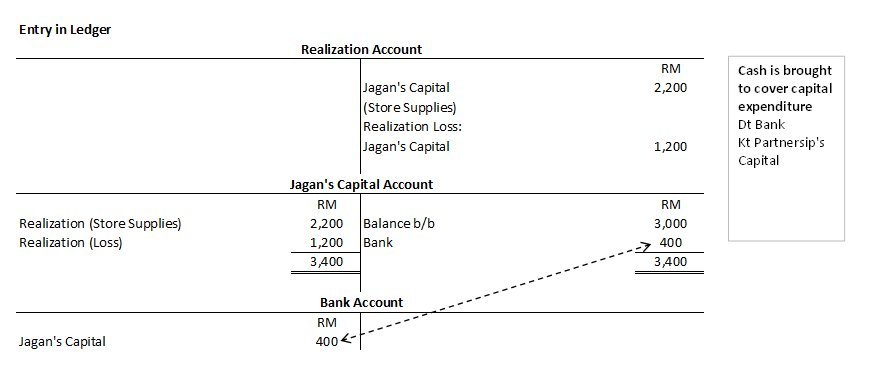

Deficit In Partnership Capital Account

- The deficit in a partner’s modal account means that the associated stake owes to the partnership. This is indicated as the debit balance in the partner’s modal Account.

- The debit balance in the partner’s account is due to the following reasons:

- realization losses debited in modal account

- the value of the assets acquired more than their capital account credit balance

3. If a partner experiences a deficit in his capital account, he is forced to bring in additional capital to cover the deficit.

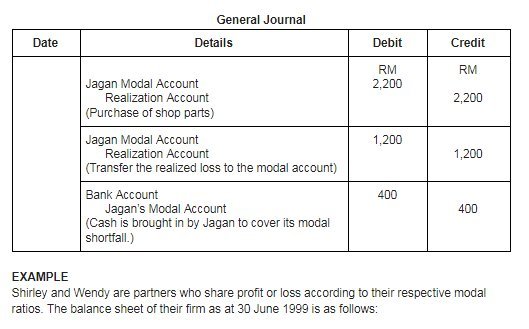

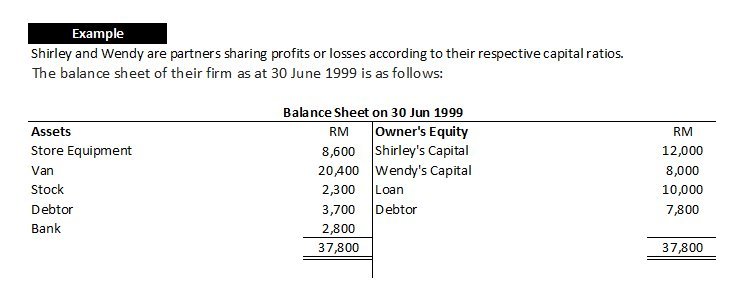

Their partnership was dissolved on 30 June 1999 in accordance with the following regulations:

- Wendy will take over shop tools at RM7,200

- Shirley will take over the stock. Less than RM300 discount.

- Van was sold at RM18,600 and RM3,300 was received from the debtor

- The loan has been fully explained.

- The creditor has paid RM7,330 to settle all claims

- The realization cost is RM570

You are required to provide:

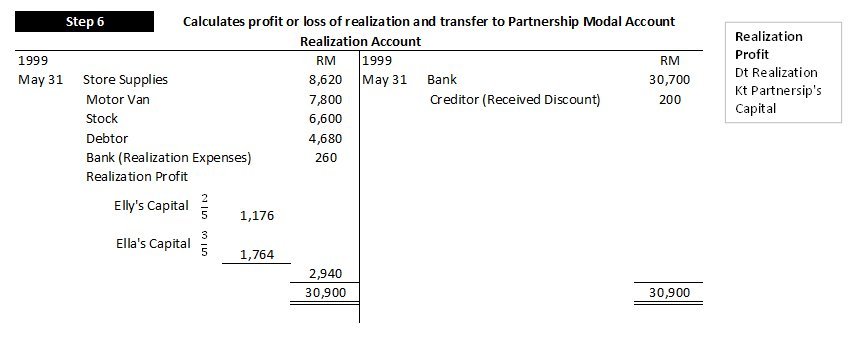

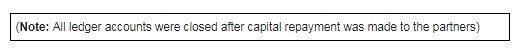

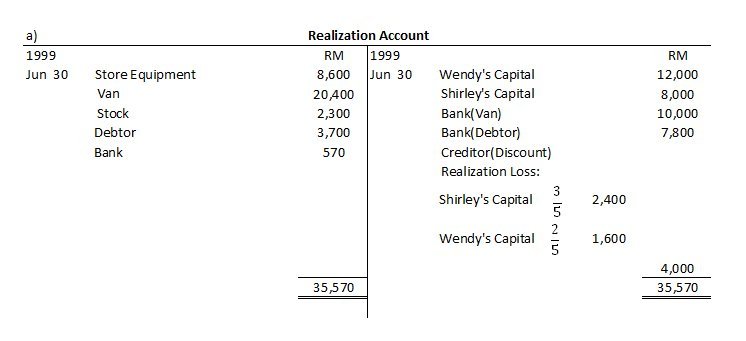

- Realization Account

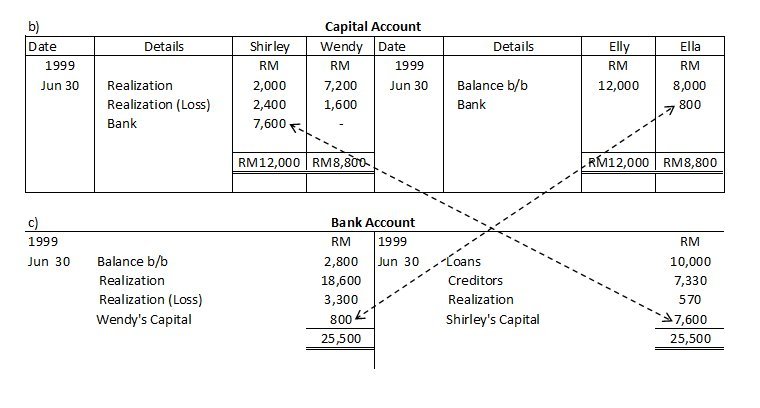

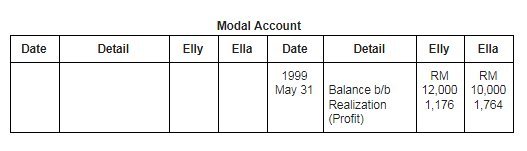

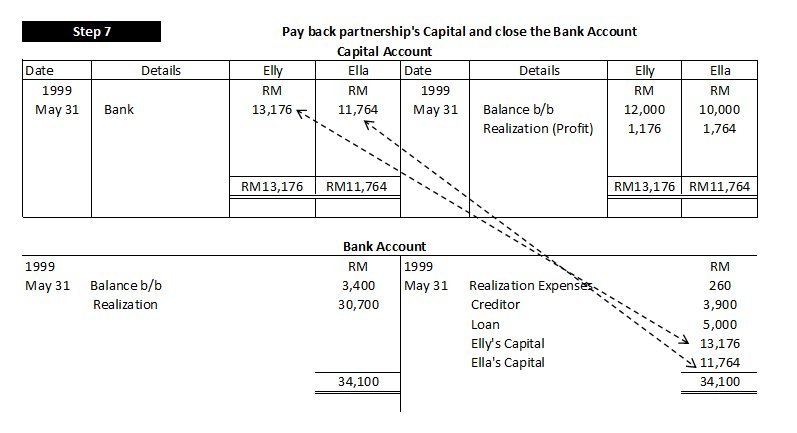

- Partner’s Modal Account

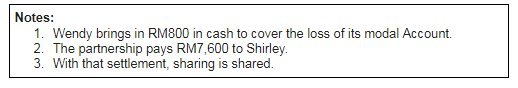

- Bank Account

Realization Account

Modal Account