- Account interpretation is a process of analyzing accounts in detail to determine the business activity that has been recorded in it for a particular accounting period.

- Information obtained from account interpretation is important for management to plan and control business activities.

Account Balance

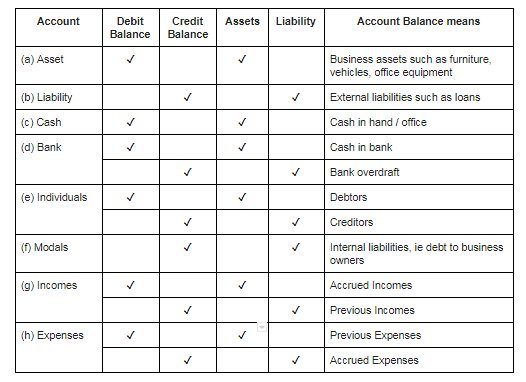

- At the end of the accounting period, the Ledger Account is offset and the balance is taken down.

- The asset account has a debit balance while the Liability Account has a credit balance.

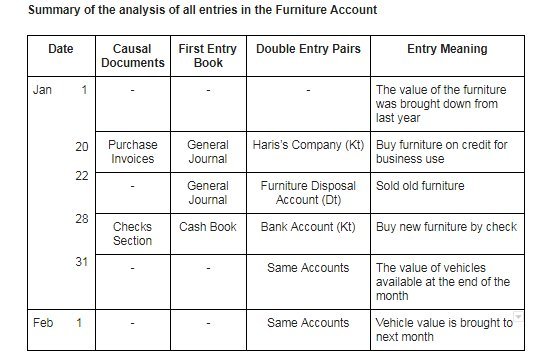

- The table below shows a summary of various accounts.

Meaning Of Each Note In Account

- Every entry in the account is a transaction that affects the account.

- The information in the account arises from the business document recorded in the Entry Book first and then posted to the account in the ledger.

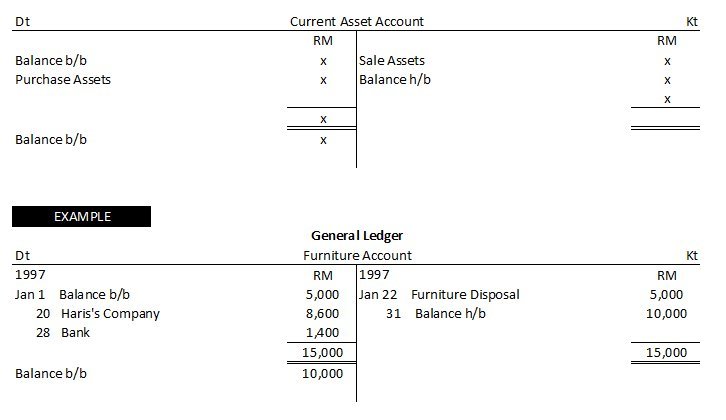

Asset Account

- An asset account records everything about an asset owned by a business.

- The basic principle of recording an Asset Account is:

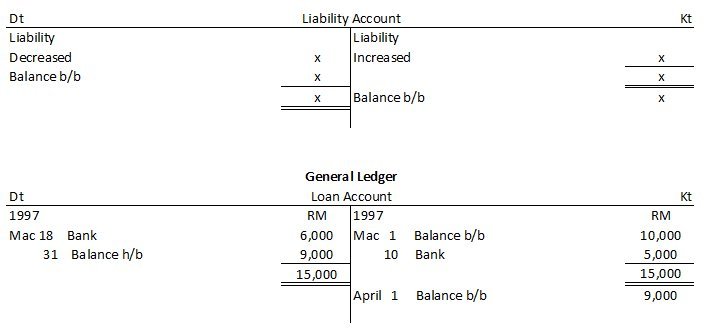

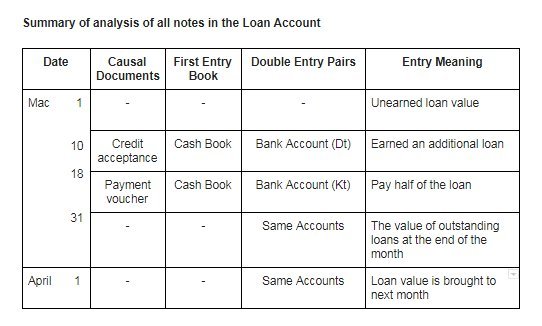

Liability Account

- The liability account records everything about business debt to external parties.

- The basic principle of recording a Liability Account is:

3. The Loan Account’s credit balance is reflected in the Balance Sheet as a long-term liability.

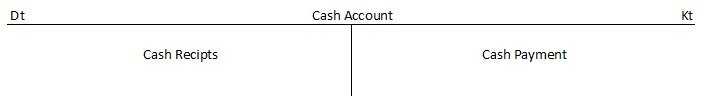

Cash Account

All transactions related to cash receipts and cash payments are recorded in the Cash Account as follows:

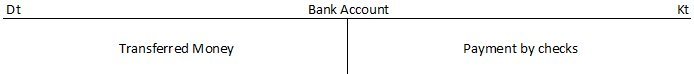

Bank Account

All transactions related to receipt of checks and payments by check are recorded into the bank account as follows:

Individual Account

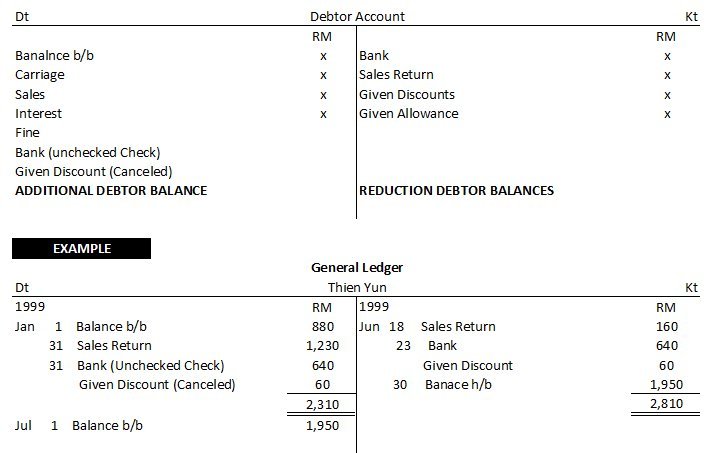

- An individual account consists of a debtor account and a creditor account

- The liability account records all transactions between the businessman and its customers and records the addition and reduction of the customer’s outstanding balance to the business as follows:

Summary of the analysis of all entries in the Debtor Account

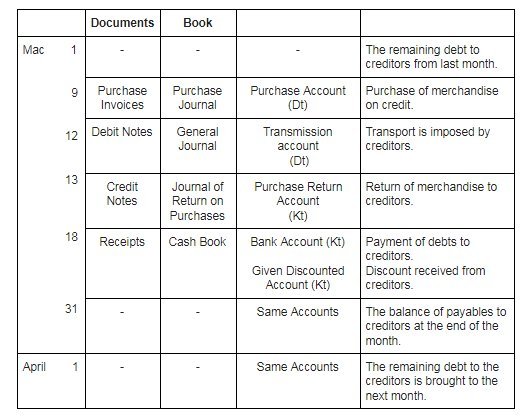

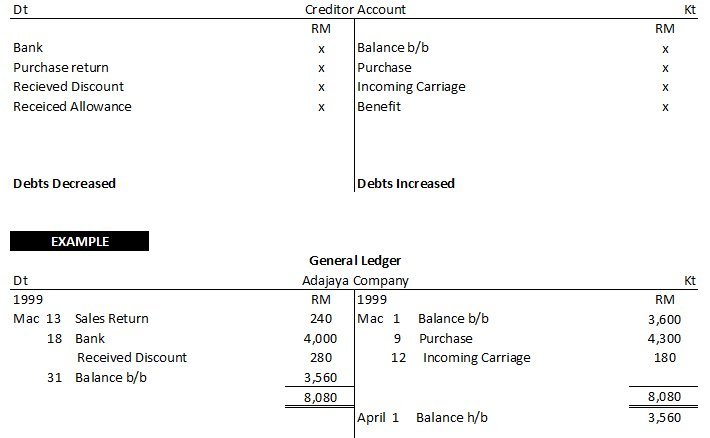

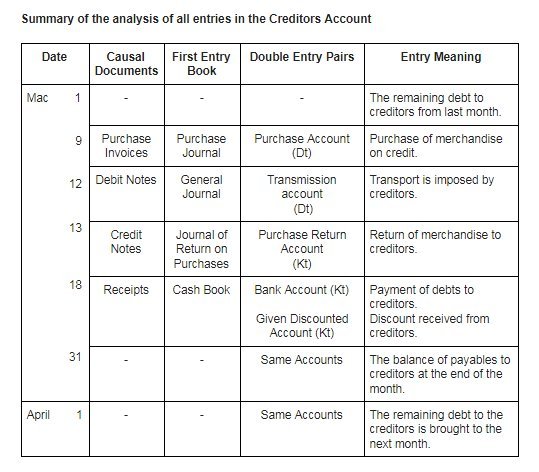

- The Accounts Creditors record all transactions between the businessman and its suppliers and record the addition and reduction of the remaining business debt to the supplier as follows:

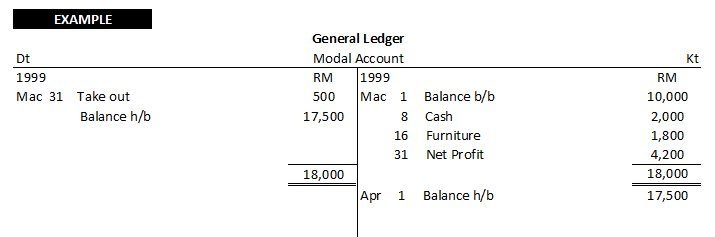

Capital Account

- Anything that adds or reduces the capital (or equity of the owner) is recorded in the Capital Account as follows:

Nominal Account

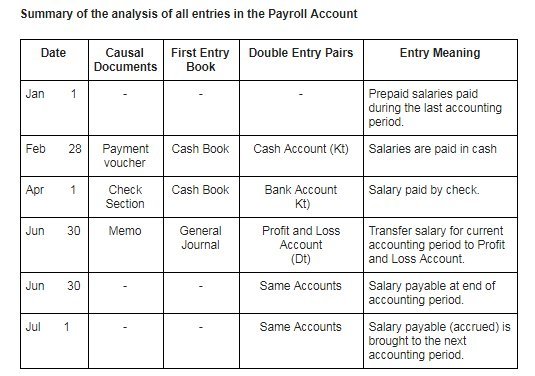

- Nominal Accounts are Expense Accounts and Income Accounts that affect the computation of business profits.

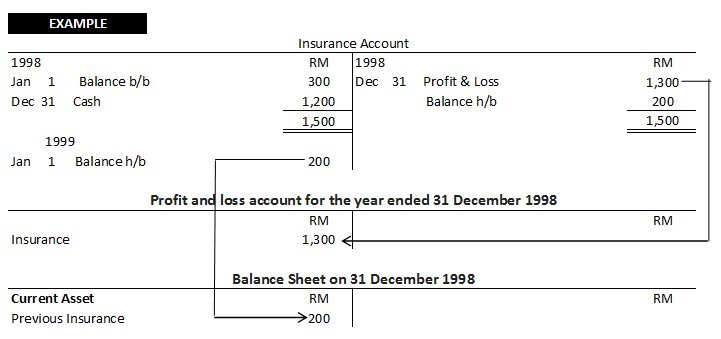

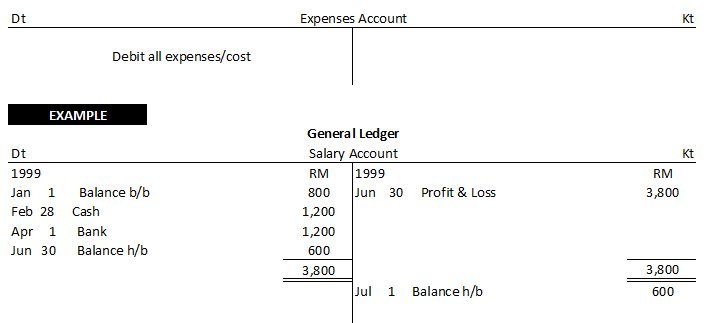

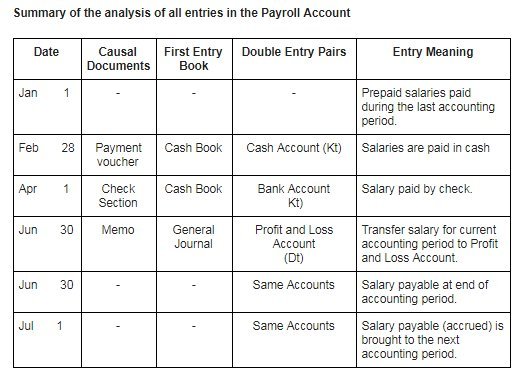

Expenses Account

- Account expenses records operating expenses that reduce business profits. For example, the payment of salaries, insurance, general expenses, mines and so on.

- The basic principles of the Shopping Account are:

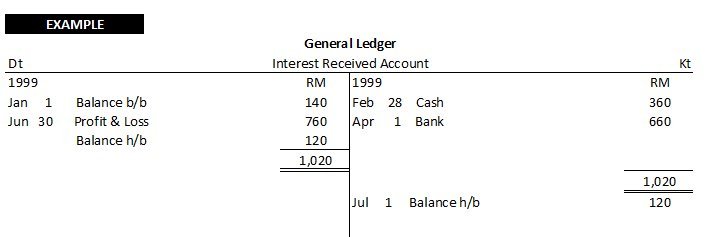

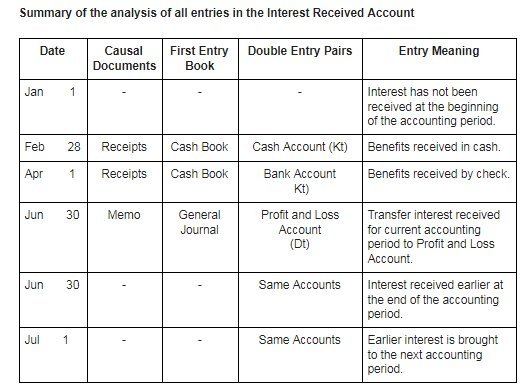

Income Account

Income accounts record revenue transactions that add business profits. For example, commissions are accepted, rent is accepted, interest is accepted and so on.

Contra Notes

- Contra notes are records recorded on two related accounts but opposite.

- Contra notes exist when there is a transfer of value between two related accounts.

- There are two types of note entries:

a. contra note in Cash Book

b.contra note in Individual Account

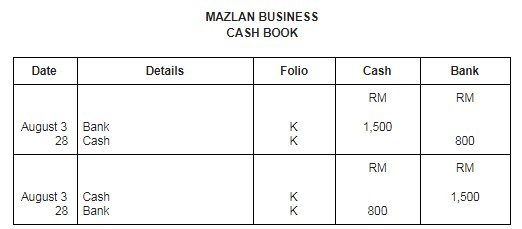

Contra Notes in Cash Book

- Contra notes occur when cash is transferred from office to bank and vice versa.

- The contra note is indicated by the “✔️” or “k” symbol in the cash book folio room.

- withdraw cash from the bank for business use.

Cash Account Debit

Cash Account Credit

- insert office cash into the bank.

Bank Account Debit

Cash Account Credit

EXAMPLE

August, 3 Mazlan’s dealer paid cash from a bank of RM1,500 for business use.

28 Mazlan dealer put an office cash amount of RM800 into the bank.

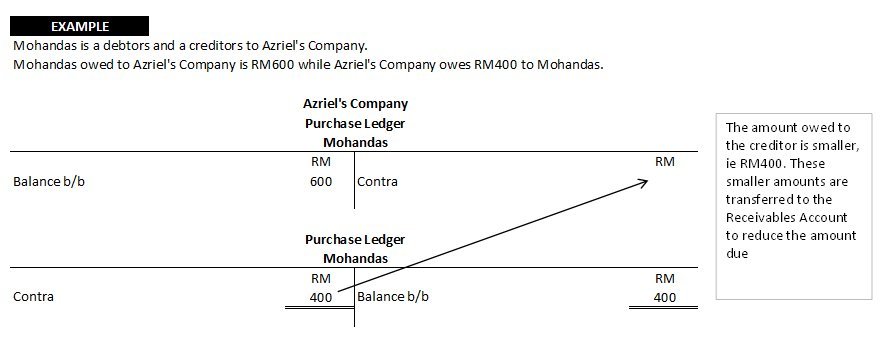

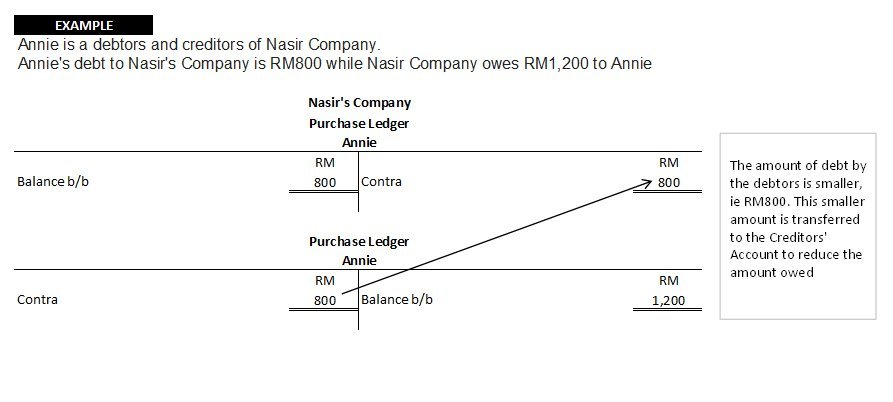

CONTRA NOTES IN INDIVIDUAL ACCOUNT

- Contra note in Individual Account involves the transfer of amounts from the Debtors Account to the Creditors Account or otherwise.

- Contra notes are only possible if the trade debtors and creditors are the same person. This means buying transactions and sale of merchandise on credit involve the same person.

- The smaller amount of an account is transferred to an account that has a larger amount to repay the amount owed.

From these two examples, it appears that the contra notes in the Individual Account are made by:

Creditor Account Debit

Debtor Account Credit

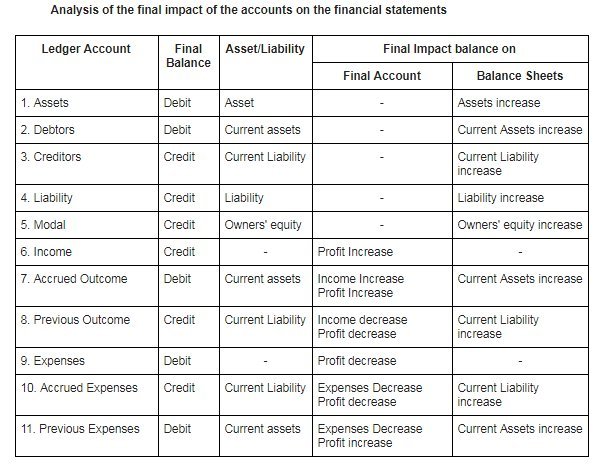

The effect of the final balance in the financial statements.

- The final balance of Expense Accounts and Income Accounts are transferred to the Final Account to determine the profit or loss of the business.

- Net profit is earned when income exceeds business expenses. On the other hand, net loss is experienced when expenses exceed business income.

- Accounts with balances brought into the future accounting period are listed in the Balance Sheet as the assets, liabilities, or owners’ equity. This includes the latest amounts and accrued for income and expense accounts.