- All accounts must be balanced or closed at the end of the accounting period

- (a) Balancing the account means mixing both sides of the debit and credit of an account to find the difference between the total debit with the credit amount of the account.

(b) If the debit amount exceeds the credit amount, the remaining h / b is next to the credit.The balance b / d at the beginning of the following month will be next to the debit. This account is said to have a debit balance. For example, Asset Account, Debtors account, Takeout Account and Expenses Account.

(c) If the credit amount exceeds the debit amount, the remaining c / d is next to the debit. The balance b / d at the beginning of the following month will be located next to the credit. This account is said to have a credit balance. For example Creditors Account, Capital Account, Liability Account, and Revenue Account.

Account with DEBIT Balance

i. Asset

ii. Takeout

iii. Debtors

iv. Expenses

Account with CREDIT Balance

i. Liability

ii. Capital

iii. Creditors

iv. Revenue

3. Closing an account means the difference between the amount of the debit and the amount of credit an account is transferred to the Ending Account, either Trade Account or Profit & Loss Account.

4. Closing an account means the difference between the amount of the debit and the amount of credit an account is transferred to the Ending Account, either Trade Account or Profit & Loss Account.

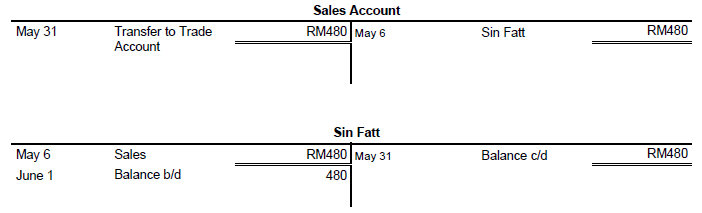

See this transactions:

May 6 Sell items worth RM480 to Sin Fatt.

Closing Revenue Account And Expenses Account

1. Revenue and expenses accounts are closed at the end of the accounting period by transferring the balance to the Ending Account (Trading Account and Profit Loss Account). This account has no balance at the end of the accounting period.

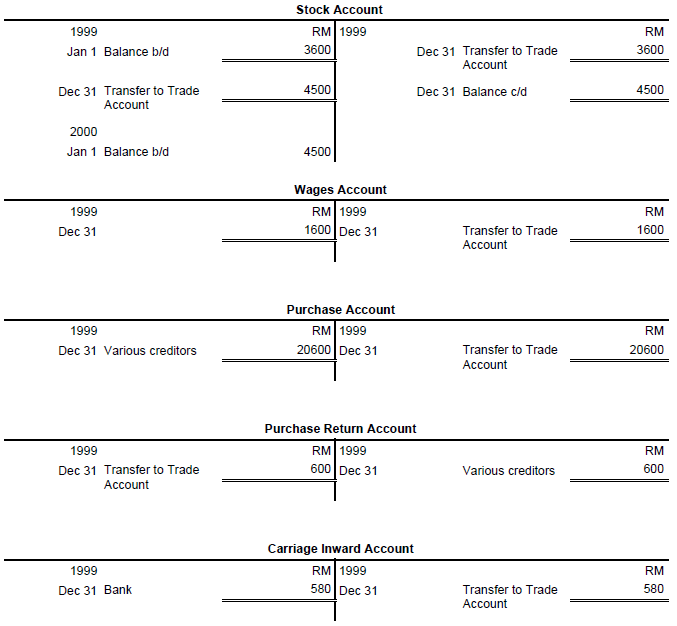

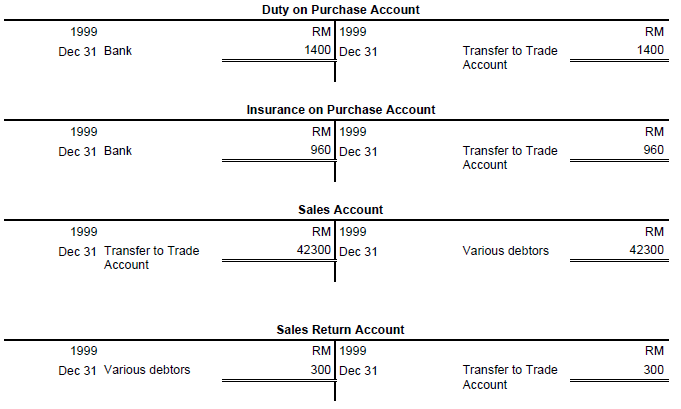

(a) Accounts that affect gross profit or gross loss are transferred to the Trade Account. For example, stocks, purchases, spending on purchases (inbound transport, on-the-job purchase, insurance on purchases, wages), returns on sales, sales, and sales returns.

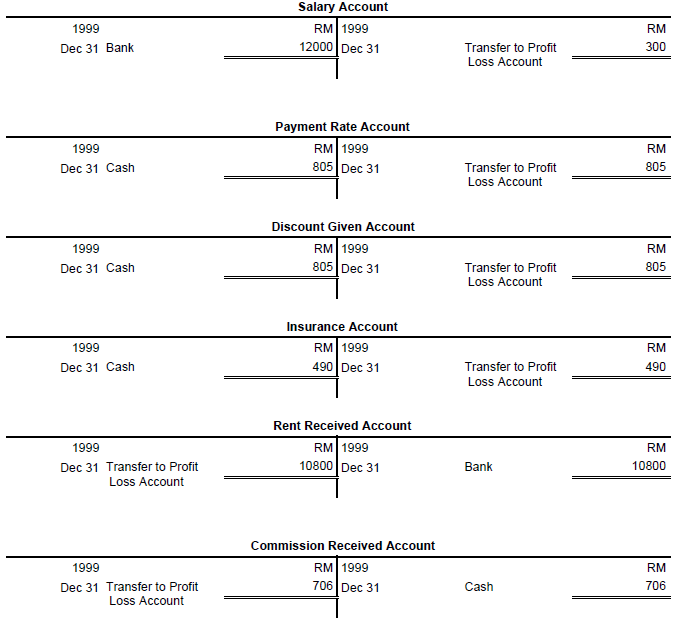

(b) An account that affects net profit or loss is transferred to the Profit Loss Account. For example, Expenses Account and Revenue Account.

2. The expenses accounts and revenue accounts are temporary or nominal accounts for one accounting period only because all expenses and revenues for one accounting period are not carried to the next accounting year.

3. The purposes of closing revenue account and expenses account at the end of accounting period are:

(a) To make sure both types of accounts will have zero balance at the beginning of each accounting period. (Revenue accounts and expenses accounts only collect information for one accounting period only.)

(b) To make sure Owner’s Capital Account can be updated. All revenues and expenses are transferred to the Profit Loss Account to calculate the net profit (or net loss) which is the difference between the amount of revenue and the amount of expenses. Then, this net profit or net loss is transferred to the Owner’s Capital Account.

– Net profit will increase the owner’s capital (owner’s equity)

– Net loss will reduce the owner’s capital (owner’s equity)

4. The closing account is done via General Journal and then posted to Ledger.

5. The accounts that affect gross profit (or gross loss) are closed by transferring to the Trading Account as follows:

6. The accounts that affect net profit (or net loss) are closed by transferring to the Profit and Loss Account as follows: