Understanding Ledger

1. Ledger is the main account book to record business transactions. Various types of accounts are recorded in the following ledger:

2. Debtors Account and Creditors Accounts are used to record credit transactions with individuals or firms. For the accounts of debtors and creditors, the word “Account” does not need to be written. Only the names of debtors and creditors are written, for example, Normah, Goldwin Company.

3. Debtors are people (firm) who are in debt with the business while the creditors are those to whom the business owes a payment.

4. The take-up account records all goods, assets, and business money that the owners take for their personal use.

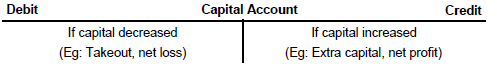

5. The Capital Account records all the assets or monies brought into the funding of the business by the owners.

6. For the accounts of debtors and creditors, the word “Account” does not need to be written. Only the names of debtors and creditors are written. For example, Normah, Goldwin Company.

How To Record Transactions Into Ledger Accounts

Individual Account

1. Individual accounts are related to the Debtors Account, Creditors Accounts, Takeout Accounts and Capital Accounts.

How To Record Individual Account

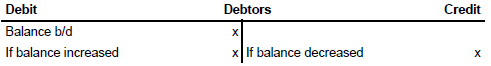

(a) Debtors

Basic principle of recording:

Example 1

May 2 Sales on credit to Mahendran RM2500

How to record transactions related to the Debtors Accounts

How To Record Individual Account

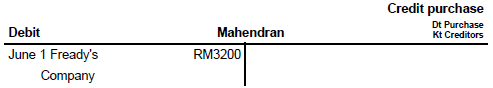

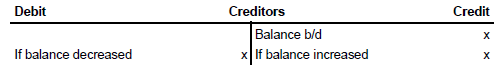

(b) Creditors

Basic principle of recording:

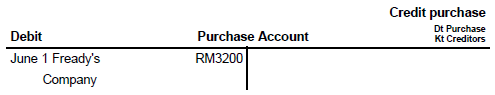

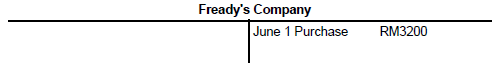

How to record transactions related to the Creditors Accounts

Example 1

June 1 Buy goods on credit from Fready’s Company worth RM3200

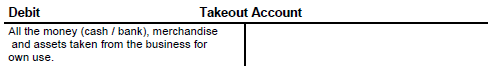

(c) Takeout

Basic principle of recording:

How to record transactions related to the Takeout Accounts

The take-up account is always debited with business details issued for your own use.

How to record transactions related to Norin Book Store Takeout Account

(d) Capital

Basic principle of recording:

How to record transactions related to the Capital Accounts

Non-individual Account

1. Non-individual accounts are used to record transactions that do not use the name of a firm or individual.

2. Non-individual account can be divided into:

(a) Real account (Asset)

(b) Nominal account

3. Real Account (Assets) records all properties (assets) owned by the business and used to help run a business. For example, premises, vehicles, furniture, office equipment, fixtures and fittings, machines, stocks, cash, and banks.

4. Nominal Accounts record all revenue and business expenses. Examples of revenue are commissions received, dividends received, discounts received, interest received, and rent received. Examples of expenses include payment rates, insurance, fares, paid rentals, advertising, discounts, stationery, salaries, and general expenses. In addition, purchase accounts, sales accounts, return inward account (or sales return), and return outward (or purchase return) accounts are also classified in the Nominal Account.

How To Record Nominal Account

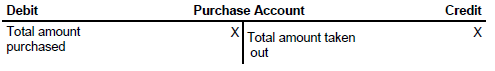

(a) Purchase Account

Basic principle of recording:

How to record transactions related to the Purchase Accounts

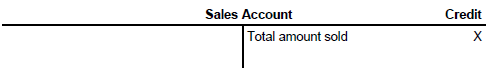

(b) Sales Account

Basic principle of recording:

How to record transactions related to the Sales Accounts

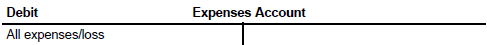

(c) Expenses Account

Basic principle of recording:

How to record transactions related to the Expenses Accounts

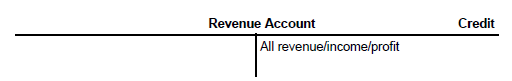

(d) Revenue Account

Basic principle of recording:

How to record transactions related to the Revenue Accounts

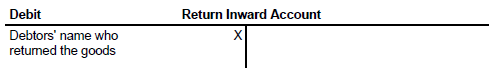

(e) Return Inward Account/Sales Return

Basic principle of recording:

How to record transactions related to the Return Inward Account/Sales Return

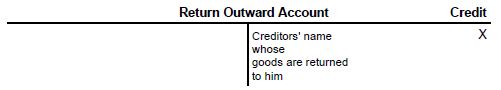

(f) Return Outward Account/Purchase Return

Basic principle of recording:

How to record transactions related to the Return Outward Account/Purchase Return

Guide To Recording Transactions Into Ledger Account

1. Transactions are recorded into the ledger in the order of the transaction date occurred.

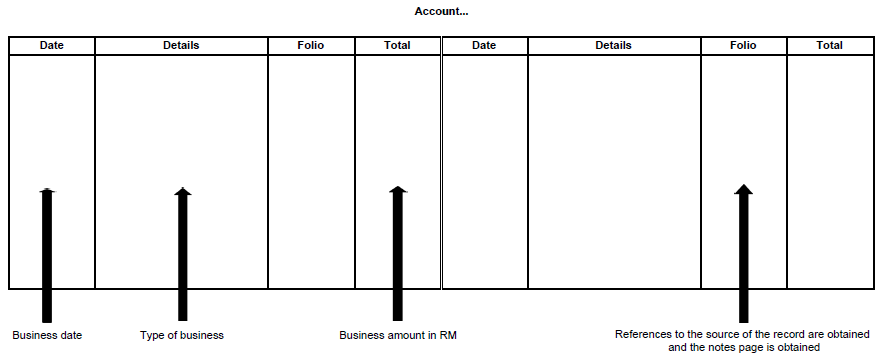

2. All entries in ledger must be complete with

(a) Date

(b) Items

(c) Transaction value

3. For Asset Account (Real Account), the same asset type can be categorized and recorded in the same account. For example, Office Equipment Account records assets such as calculators, computers, fax machines, and typewriter machines.

4. The guidelines to record transactions in ledger is as follows:

(a) Identify the accounts that are involved in a transaction

(b) The account will be debited and other accounts (its partner) will be credited with the same amount.

(c) Record based on a double entry system in the order of dates.