1. Basic accounting equations can be extended by incorporating the equity component of the owner, ie capital, revenue, and expenses as follows:

Which,

2. When a transaction involves revenue and expense, profit or loss will be available:

3. From the accounting equation, the revenue derived from the transactions will lead to an increase in assets, or the reduction of liabilities. Such instances include:

(a) When merchandise is sold in cash, assets are increased in cash.

(b) If the merchandise is sold on a credit basis, assets are increased in the form of debtors.

(c) If the proceeds are used to pay the creditor, the liability will be reduced in the form of creditors.

4. Expenses result in asset diminution, or in other words, an increase in liabilities. When an item is paid in cash, liability is incurred in cash, or rather, the assets in cash are reduced. If an expense remains unpaid, the liability increases in the form of accrued expenses.

Example 1

| Business Transaction | Effect on | ||

| Asset | Liability | Owner’s Equity | |

| I. Buy goods worth RM300 in cash |

| ||

| II. Buy goods worth RM760 on credit | Stock (+RM760) | Creditors (+RM760) | |

| III. Sell items worth RM80 with cash at RM95 |

| Capital (+RM15)(Profit) | |

| IV. Sell items for RM360 on credit at RM400 |

| Capital (+Rm40)(Profit) | |

| V. Pay a fee of RM150 in cash | Cash (-RM150) | Capital (-RM150)(Loss) | |

| VI. Pay the loan interest of RM95 in cash | Cash (-RM95) | Capital (-RM95) | |

| VII. Receive a commission of RM55 in cash | Cash (+RM55) | Capital (+RM55)(Profit) | |

| VIII. Pay creditors with checks of RM420 and receive a RM80 discount. | Bank (-RM420) | Creditors (-RM500) | Capital (+RM80)(Profit) |

| IX. The receivables pay with a check worth RM810, giving him a RM90 discount |

| Capital (-RM90)(Loss) | |

| X. Take Rm90 worth of goods for your own use | Stock (-RM900) | Capital (-RM90)(Drawing) | |

| XI. Get a loan from a bank of RM6000 | Cash (+RM6000) | Loan (+RM6000) | |

| XII. Business owners bring in a table from his home worth RM75 for business use | Furniture (+RM75) | Capital (+RM75) | |

| XIII. Checks from debtors of RM350 are not entertained by banks. |

| ||

Example 2

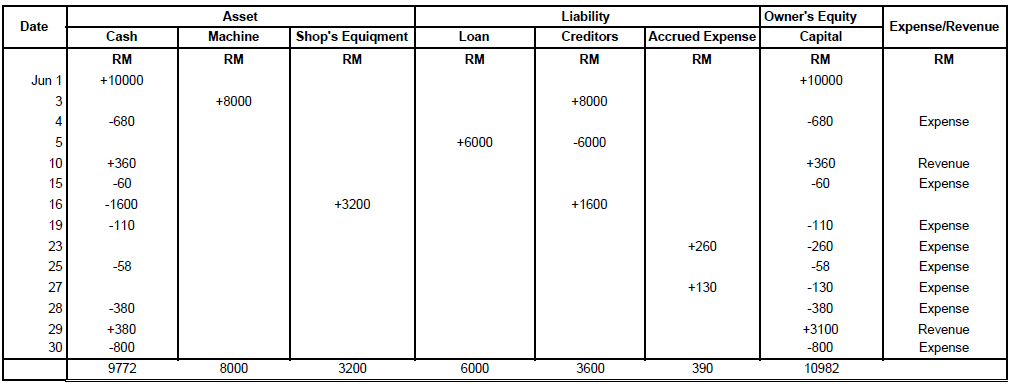

Mahani operates a photostat service center. The following is a business transaction during June 1998.

June 1 Mahani brings in cash Rm10000 to start his business.

3 Purchase two photocopiers on credit at RM4000 per unit.

4 Purchase a supply of RM680 in cash.

5 Obtained a bank loan of Rm6000 to settle the debts to creditors of photocopier machines.

10 Received RM360 from photostat service.

15 Paying for general expenses of RM60 with cash

16 Purchase shop equipment worth RM3200. Half of them are paid in cash and the balance will be paid next month

19 Pay your own retail expenses with business cash of RM110.

23 Accepts an RM260 bill to repair and maintain a photostat machine.

25 Paying a phone bill of RM58 for cash.

27 Received electricity and water bills of RM130 for June.

28 Paid a shop assistant’s salary of RM380 with cash.

29 Received RM3100 from photostat service.

30 Pay rent in cash RM800

(a) Record the transaction using the format of the column showing the types of assets, liabilities, and owner equity. Summarize those items on June 30, 1998.

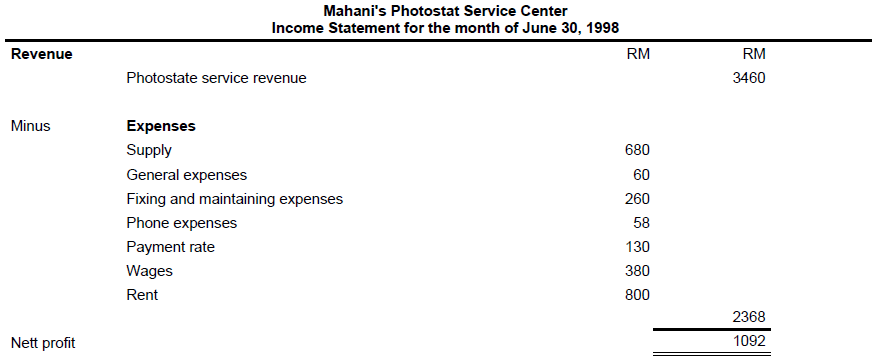

(b) Prepare Income Statement for the month ended 30 June 1998.