Revenue

1. Business revenue is derived from the proceeds of the sale of company goods and services. There are two types of revenue, namely:

(a) the revenue of business conduct, which includes the proceeds from the sale of merchandise or from services rendered;

(b) non-operating revenue, which is unrelated to the main company activities, such as revenue derived from savings interest, rent, dividends from investments and profits from the disposal of fixed assets in use.

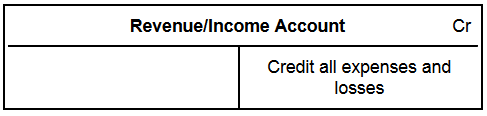

2. The principle of profit sharing is:

6. Revenue will add equity to business owners.

Expenses

1. Expenses is the cost of services or goods used in the process of earning revenue.

2. An imbalance expense has occurred when the expense is used to earn revenue within a period of accounting, regardless of whether the expenses have been paid or not.

3. There are two types of expenses:

(a) business operating expenses

(b) non-expenses business conduct

4. Business expenses are expenses incurred in conducting daily business transactions, such as rent paid, salary, electricity, and water (rates), transportation expenses, insurance, telephone expenses, general expenses, stationery, advertising, etc.

5. Non-business expenses is an expense that is unrelated to the usual daily routine of a business, such as a bank loan interest, loss on sale of used fixed assets, and losses caused by natural disasters or unforeseen occurrences such as floods, fires, thefts, etc.

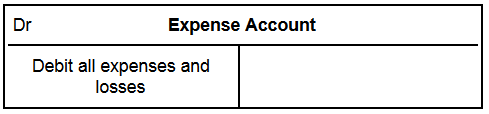

6. The entry principle for expenses is:

7. Expenses will reduce owners’ equity.

Assets

1. Assets are property owned by a business and used to carry on business activities.

2. Assets are divided into two types, namely:

(a) fixed assets

(b) current assets

Fixed Assets

1. Fixed assets are assets that are durable and can be used for some accounting periods. For example, premises, vehicles, machines, office equipment, furniture, fixtures and accessories, and so forth.

2. Fixed assets are not for resale for profit. This asset is used to help run a business.

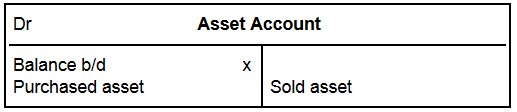

3. The notes principle for fixed assets is:

Current Assets

1. Current assets can be converted into cash during the accounting period.

2. Examples of current assets are stocks of merchandise, debtors, cash in banks, cash in hand, and accrued revenue. The forms and values of current assets tend to vary during the accounting period.

LIABILITY

1. Liabilities are the liabilities of the business side to the outsider and need to be settled by money, goods, or services.

2. Liability is a claim to a business asset as the lender to the business is entitled to claim payment from the business.

3. Liabilities can be divided into two types, namely:

(a) Long term liability (> 1 year)

(b) Current liabilities (< 1 year)

Long Term Liability

1. Long term liabilities are business payables that are not repayable within a year or an accounting period.

2. Examples of long-term liabilities are secured loans, loans, and mortgages.

Current Liability

1. Current liabilities are business payables that are repayable within one accounting period or a year.

2. Examples of current liabilities are bank overdrafts, creditors, accrued expenses, and past revenue.

Owner’s Equity

1. The owner’s equity is the liability of the business side to its owner. This is because business owners lend money to businesses as capital to start their business.

2. Owners’ equity included:

(a) the capital invested by the owner into the business (initial investment and additional investment)

(b) net profit because of profitable business activities

3. Capital investment by the owner and net profit will increase owner’s equity while the uptake and loss will reduce the owner’s equity. Observe the following formula:

Early Capital + Nett profit – Drawing = Final Capital

Early Capital – Nett loss – Drawing = Final Capital

4. The owner’s equity is the owner’s claim on the business assets.

5. Owner’s equity resources can be found through a variety of ways, depending on the type of business organization:

| Types of Business Organization | |

| Sole proprietorship |

|

| Partnership |

|

| Limited company | The money collected from the issuance of shares to shareholders and the public |

6. If the business asset is contributed by its owner, the accounting equation is as follows:

Asset= Owner’s Equity

7. If business assets are contributed by its owners and other lenders (liabilities), then the accounting equation is as follows:

Asset = Owner’s Equity + Liability

or

Owner’s Equity = Asset – Liability

or

Liability = Asset – Owner’s Equity