1. Income Statement summarizes the effects of business activity for an accounting period whether the profit or loss is earned for that period.

2. Income statements have two main components:

(a) results

(b) spending

3. Nett profit is earned if revenue exceeds expenses while net loss occurs when expenditure exceeds revenue.

Revenue > Spending → Net Profit

Revenue < Expenses → Net Loss

The Income Statement has the following information:

(a) the name of the business

(b) the title of the statement

(c) the accounting period for the relevant statement

4. The Income Statement has the following information:

(a) the name of the business

(b) the title of the statement

(c) the accounting period for the relevant statement

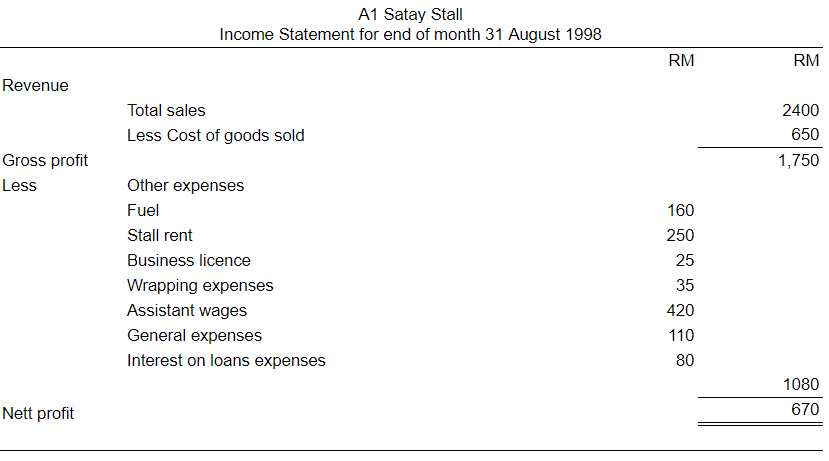

Example:

The following is the information provided by Khalid who manages the A1 Satay Stall.

| Total amount of sales for August 1998 | RM2400 |

| Material cost used (meat, cucumber, onion, etc.) | 650 |

| Other expenses in August: | |

| Fuel | 160 |

| Stall rent | 250 |

| Business licenses | 25 |

| Wrapping expenses | 35 |

| Assistant wages | 420 |

| General expenses | 110 |

| Interest on loans expenses | 80 |