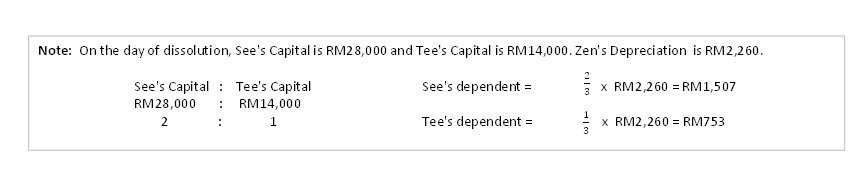

1. If a partner with a debit balance in his capital account is unable to bring in additional cash to cover his / her modal account, then the Garner law against Murray are imposed.

2. This rule states that the modal deficit of one unpaid partner will be borne by other partners in accordance with their respective fixed modal ratio at the date of the dissolution.

3. The conditions for this rule are:

- The dissolution partnership has at least three partners.

- One of the partners is unable to bring in cash to cover its modal account deficit.

EXAMPLE

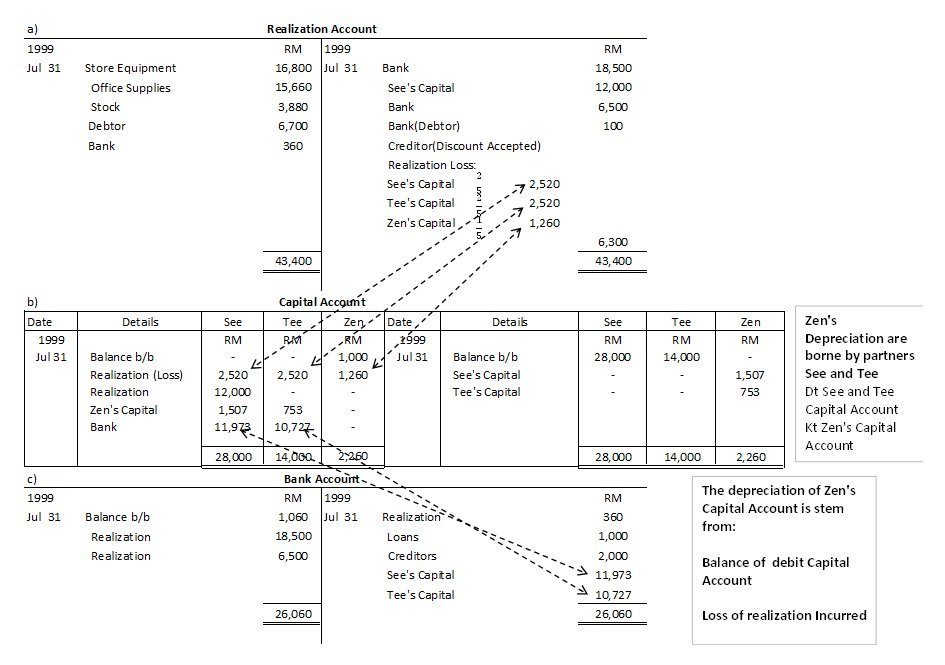

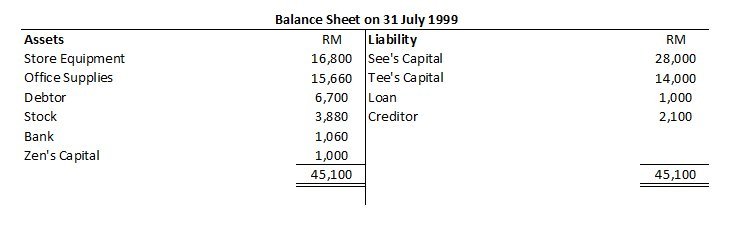

See, Tee and Zen are sharing partners doing business selling watches. They share a profit loss ratio of 2: 2: 1. On July 31, 1999, the Balance Sheet was as follows:

The three partners wanted to retire and sell their business on July 31, 1999. The following details are about the dissolution.

- The shop was sold at RM15,000 while the stock was sold at RM3,500.

- Office equipment taken over by See at RM12,000

- The dissolution fee of RM360 was paid.

- Bank loans are fully paid.

- A sum of RM6,500 is collected from the debtor after deducting bad debts and discounts.

- The creditors are fully paid up to RM2,000

After all assets are realized and the liabilities are explained, Zen is declared bankrupt and unable to settle his debt.

You are required to provide:

- Realization Account

- Partner’s Capital Account

- Bank Account

- Journal entries to close the firm’s account